One person like that

#officespace

One person like that

"Office Space" https://youtu.be/zrcLKT9iuw4

Hell yes!

Tags: #dandelíon #officespace #movie #comedy

via dandelion* client (Source)

6 Likes

#movie #officespace

OFFICE SPACE

Clip

I love this movie.

https://www.youtube.com/watch?v=jsLUidiYm0w

2 Likes

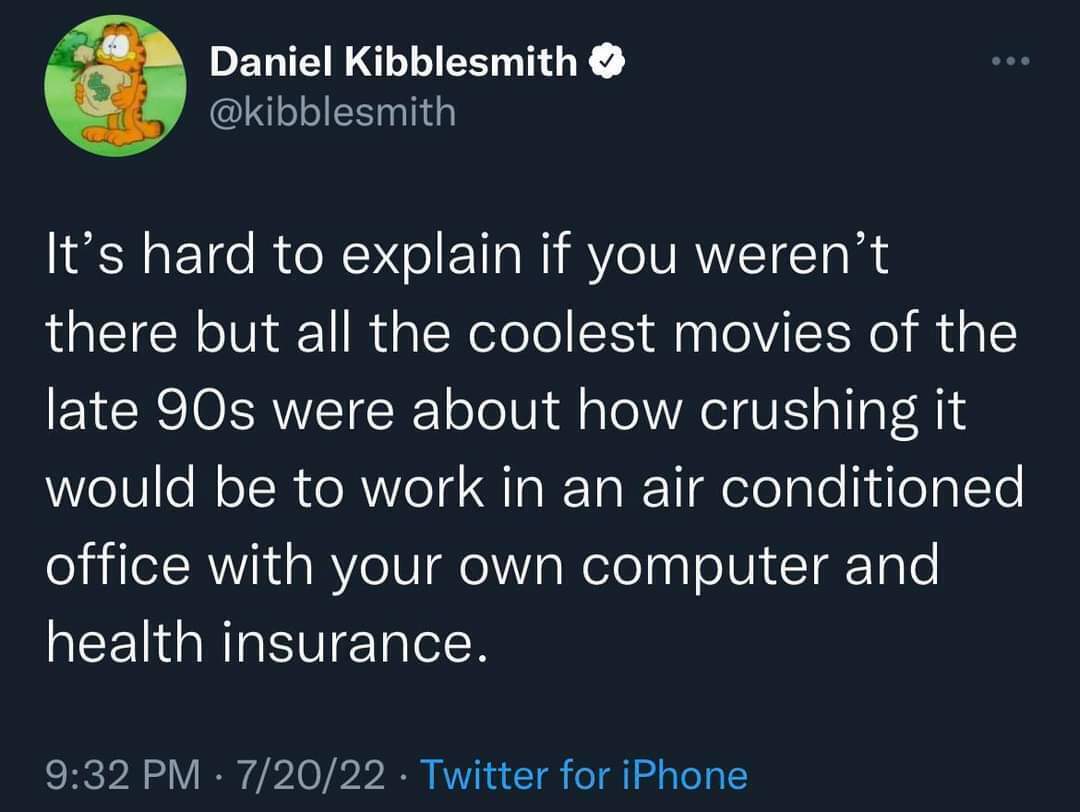

What's with increasing "back to the office" arguments? Real Estate and Finance interests

A pretty uninspired blog post and HN discussion ask, and all but completely miss the point of "Why do so many people want us back in the office?".

Commercial real estate interests -- landlords, building management and services companies, but most especially banks and finance companies with a toe in the $2.5 trillion office market, a sizeable fraction of the total $14--17 trillion+ commercial property market (https://www.reit.com/data-research/research/nareit-research/estimating-size-commercial-real-estate-market-us), and all the interrelated securities backed by or tied to it --- have a profound interest here. Leasing volume fell by over 50% per some reports, which is of course huge.

You'll find articles addressing this, largely in the business and financial press, e.g.,

"Coronavirus set to usher in big changes at U.S. offices"

https://www.reuters.com/article/us-health-coronavirus-usa-officespace/coronavirus-set-to-usher-in-big-changes-at-u-s-offices-idUSKBN21Y334

"Pandemic exposes ‘severe stress’ in commercial property financing"

https://www.ft.com/content/e4b2302b-76c5-494a-8560-e6d24de9358f

"Suburban Philly offices feel the brunt of COVID-19’s economic toll"

https://www.inquirer.com/business/suburban-office-distressed-debt-defaults-covid-coronavirus-cmbs-center-city-20200823.html

"COVID-19 and real estate: How the coronavirus is impacting the AEC industry"

https://www.bdcnetwork.com/covid-19-and-real-estate-how-coronavirus-impacting-aec-industry

"United StatesOffice Outlook – Q2 2020" https://www.us.jll.com/en/trends-and-insights/research/office-market-statistics-trends

Contrast the outlook as of October 2019: "base fundamentals indicate that the US CRE market remains on a strong footing,' from Deloitte: "2020 commercial real estate outlook"

https://www2.deloitte.com/us/en/insights/industry/financial-services/commercial-real-estate-outlook.html

That's not to say that sandwich shops and individual workers and managers don't have concerrns, but their voices are far more relatable and telegenic than faceless megabanks. Even genuine and spontaneous statements can be repeated and amplified by other interests.

One person like that

Office Space: Not the movie

Coronavirus set to usher in big changes at U.S. offices

... LANDLORDS NOT IN DRIVERS SEAT

Publicly traded owners of office buildings have been challenged in New York for some time.

The share prices of SL Green Realty Corp (SLG.N) and Vornado Realty Trust (VNO.N), two of the city’s largest landlords, slid about 20% in the five years through the end of 2019 when the S&P 500 index rose 57%. Their stock fell twice as fast in the recent downturn on concerns some tenants would be unable to pay their rent.

...

Scott Nelson, chief executive of occupier services at Atlanta-based brokerage Colliers International, said that while office space demand overall will slacken as companies accommodate a workforce that chooses to work from home, some will rent the same amount of space, but design it less densely for fewer workers to maintain social distancing.

Elevators get complicated. Maintaining six feet of distance means long ground-floor lines to get to the office, a certain discouragement for commuters, unless more elevator banks are installed.

Social distancing in elevators would be a neat hack. Personal body bags? Return of the Paternoster?

One person like that

2 Comments