#robinhood

today's #backofanenvelope #wealthredistributionpotential calculations [paste @ end of post], without even including half the items of dormant wealth consolidations and squanderances as done last time (and even that time there were still many more parts missing), just from adding the estimated millionaires and billionaires wealth, it still came out as 300K each... which is 50% more than the previous calculations. :3

and that's of course still not taking into account the synergistic potentials, the loss of poverty drag, the unleashing of emancipatory technologies and other innovations.

we have so much headroom.

we can still mend this.

#plentyheadroom

#wecanstillmendthis

ps, hastening to add: not advocating #robinhood style #wealthredistribution, just having fun to think about #resourcepotential and #economics and the numbers.

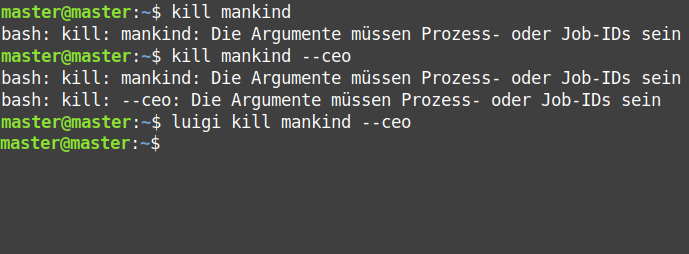

GHCi, version 9.0.2: https://www.haskell.org/ghc/ :? for help

ghci> billionaireinterest=2700000000

ghci> billionaireovertwealth=7000000000000

ghci> millionaires=60000000

ghci> avgmillionairewealth=20000000

ghci> millionaires * avgmillionairewealth

1200000000000000

ghci> millions = millionaires * avgmillionairewealth

ghci> billionaireannual = billionaireinterest * 365

ghci> billionairehiddenwealth = billionaireovertwealth * 6

ghci> billionaireswealth = billionaireovertwealth + billionairehiddenwealth

ghci> billionaireswealth + millions

1249000000000000

ghci> pop = 8000000000

ghci> billionaireswealth + millions / pop

4.900000015e13

ghci> pop

8000000000

ghci> mic=4000000000000

ghci> inflation=(100000000000*150)

ghci> rotnin=200000000000000

ghci> ggdp=100000000000000

ghci> energy=20000000000000

ghci> wallstextract=109000000000000

ghci> wallstdestroy=wallstextract*7

ghci> wallstreettotal=wallstextract+wallstdestroy

ghci> vaticangold=60000*1000000*420/100*90

ghci> billionaireswealth + millions + mic + inflation + rotnin + ggdp + energy + wallstreettotal + vaticangold

2.48268e15

ghci> billionaireswealth + millions + mic + inflation + rotnin + ggdp + energy + wallstreettotal + vaticangold / pop

2.460000000002835e15

ghci> ( billionaireswealth + millions + mic + inflation + rotnin + ggdp + energy + wallstreettotal + vaticangold )/ pop

310335.0

ghci>

● NEWS ● #Techdirt ☞ Hacker Tricked #Robinhood Support Into Revealing Data Of 5 Million Users https://www.techdirt.com/articles/20211109/08420747907/hacker-tricked-robinhood-support-into-revealing-data-5-million-users.shtml

● NEWS ● #Quartz #Finance ☞ To Redditors, #Robinhood isn’t a meme stock any more https://qz.com/2049776/robinhood-isnt-a-meme-stock-on-reddit-any-more/

What #banksters do is vastly worse than #Robinhood , but they control the system and thus get away with all their thieving crimes https://fortune.com/2021/07/29/robinhood-has-become-a-cultural-moment-now-even-bankers-worry-its-ipo-will-be-a-meme-palooza/

ha les capitalistes unis, si tu casses leur jouet ben ils changent les règles, des grands enfant en fait...

https://gizmodo.com/google-deletes-100-000-negative-reviews-of-robinhood-ap-1846156699

“This is no longer about money, it’s about sending a message,” one Reddit user exclaimed.

https://phillipschneider.com/investors-issue-class-action-lawsuits-against-robinhood-over-gamestop-stock-trading-ban/

#Robinhood #GME #WallStreetBets

Cory Doctorow has an excellent #Gamestop / #Robinhood / #CitadelCapital explainer:

… But there’s a third story, and I think it’s the most important one. That’s Alexis Goldstein’s account of what’s going on with Robinhood and the institutional investors it’s in bed with.

https://marketsweekly.ghost.io/what-happened-with-gamestop/

Recall that all of this is only possible because Robinhood lets average joes buy and sell stocks for free. How can Robinhood give away a service that costs it money and still stay in business? (Hint: They’re not making it up in volume).

The answer is: surveillance. Robinhood partners with institutional investors and lets them spy on what the average joes are buying and selling. Sometimes, this is just “market intelligence” (“Hey, people like fidget spinners”) but the main event is front-running.

If you’re paying Robinhood to tell you what assets its customers are about to buy, you can go out and buy them up first and sell them for a profit to Robinhood’s customers.

Or you can buy some of that asset up because you know its price will go up once Robinhood’s customers orders are filled.

Or both.

Citadel Securities is Robinhood’s main institutional investor partner. Founded by billionaire Ken Griffin, they combine tech (high-frequency trading), an “asset manager” (they spend other peoples’ money) and a “market maker” (they sell things like options).

Citadel gets to see all those r/wallstreetbets buy orders before they’re filled. They can fill some of those orders, making a profit. They can buy some of the same stock for themselves, making a profit. They can sell options, making a profit.

A little bit of this profit comes at the expense of average joes: if there wasn’t a front-runner marking up the stocks they buy, the average joes would pay a little less. But the average joes are still profiting from the destruction of the shorts.

Citadel is merely taxing their winnings. The real losers here, though are Citadel’s competitors, funds like Melvin Capital, who were seriously short on Gamestop and went bust thanks to all of this. Guess who bought Melvin at fire-sale prices? That’s right, Citadel.

So the third story goes like this: there are a lot of average joes. They’re numerous, pissed and smart. They move a lot of money against shorts and make it go farther thanks to the force-multiplier effect of options.

Then all this activity is multiplied again by Citadel, a fund that is no better (and no worse) than Melvin or the other targets of the average joes’ wrath. Citadel’s bots are triggered by the average joes’ activity, which turns kilotons of damage into gigatons. …

https://pluralistic.net/2021/01/28/payment-for-order-flow/#wallstreetbets

Robin Hood is an investment app I've been using. AMC and Beyond Meat stocks are doing really well right now. Sign up with my referral link and we'll both get a free stock!

https://join.robinhood.com/phillis-679374

#Stocks #Investing #RobinHood #Money #Finance