#wealthtax

Mitch's Court

I keep hearing only Trump being credited for the current SCOTUS but y'all best be mindful of the orchestrator: Mitch McConnell.

♲ Persagen.com 🇨🇦 🏳️⚧️ ☮🌈 - 2023-06-30 16:33:51 GMT

A New Supreme Court Case Could Make It Harder to Tax the Superrich

SCOTUS just agreed to hear a case designed to preemptively block a wealth tax — another potentially lucrative gift for the conservative justices’ billionaire benefactorsMoore v. United States, is tailored to try to block Democrats’ promised agenda by defining what can — and cannot — count as taxable “income” under the Constitution.Moore v. United States: https://www.scotusblog.com/case-files/cases/moore-v-united-states-3/

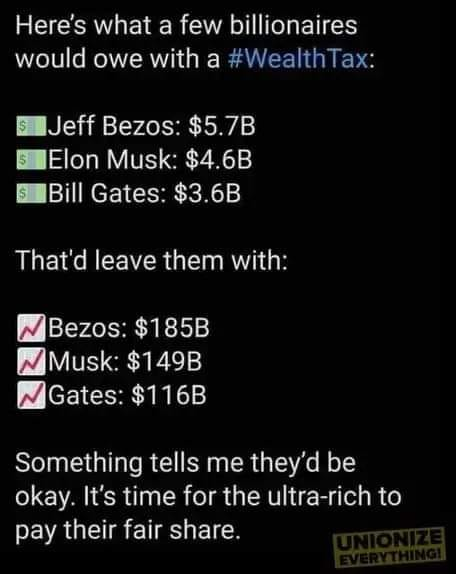

Time to tackle another meme: Of Billionaires and "wealth hoarding"

This is floating around presently, and it's hardly a new notion. There's some truth to the sentiment, and I agree that the issue deserves addressing. But as with many other failures of metaphors (not to be confused with metaphorical failures), the imagery evoked does some disservice to the actual problem. Much as the debt of a currency-sovereign nation is not comparable to that of a non-currency-sovereign household, most billionair wealth is not a case of simply hoarding money or resources. It's based on control over assets and their valuation. Not dissimilar, but also not quite the same thing.

So ... it's not necessarily hoarding in all cases. Not as a defence, but as a point of accuracy.

And to be clear, there are instances (often in multi-generational family wealth) where it is hoarding.

But it often isn't, and I think the distinction matters. Not to excuse the behaviour, but to understand what is actually occurring.

For many of the wealthy, it's not that they went out and collected trinkets, plucking coins from the hands of babes or whatever, one by one. Or even in aggregate. They didn't pile up resources.

Rather, they gained control over some specific set of assets, and then saw those appreciate in market value. That is, their wealth comes (mostly) not from piling up of stuff but through the accrual, or, yes, manipulation, of valuation.

A billionaire doesn't have a literal bank account with a billion pieces of gold in it. They have an asset portfolio whose notional value (itself a ... complicated question) is reckoned at over $1 billion. That wealth itself is not liquid, as cash is. And there are times when valuations have changed precipitously and someone previously considered rich suddenly found that they were not.

(Among the chief reasons for that portfolio, by the way, is to diversify risk associated with holding a single asset overwhelmingly, or the inflationary risk of holding cash itself.)

Wealth gains can happen fairly suddenly. In the case of Bill Gates (Microsoft), Steve Jobs (Apple), Jeff Bezos (Amazon), and Elon Musk (Tesla), often the bulk of gains was over a relatively short period of rapid growth --- the late 1980s for Gates, 2000s for Jobs (he'd largely lost out on earlier gains by Apple, Pixar, and Next), early 2010s for Bezos, and the past few years for Musk. Holdings that they already had escallated rapidly in value.

The reasons why are not always innocent: Microsoft and Amazon have both long engaged in monopoly antitrust abuses. Apple and Tesla's hands aren't entirely clean as well, though my sense is that they're cleaner. Balzac's dictum that behind every great fortune lies an undiscovered crime ... has a strong element of truth to it.

The means by which assets inflate is ... another interesting puzzle. I'll raise the question here, though I won't be answering it now. Suffice to say that value can also be gamed, and that often the greater that value is, the more the gaming potential increases.

But stop thinking of this as earned money --- whether through income, payments, or simple hoarding and pillaging. It's neither: it's accrued wealth, often through appreciation, and behaves (and should be addressed) in a different manner.

#wealth #inequality #hoarding #assets #AssetValuation #HonoreeDeBalzac #SoWhatchyaGonnaDoAboutIt #WhatThenShallWeDo #WealthTax #Plutonomy #Kleptocracy #PropertyIsTheft #bilionaires #memes

● NEWS ● #CommonDreams ☞ Opinion | #NDP Should Push Liberals for Public Hearings on Popular #WealthTax https://www.commondreams.org/views/2021/09/23/ndp-should-push-liberals-public-hearings-popular-wealth-tax

● NEWS ● #TruthOut #Finance ☞ #WealthTax and #IRS Funding Could Pay for Entire $3.5T Bill, Warren Writes https://truthout.org/articles/wealth-tax-and-irs-funding-could-pay-for-entire-3-5t-bill-warren-writes/

ProPublica's "The Secret IRS Files" and the difficulties of a wealth tax

I've seen a lot of discussion, little of it elucidating, and that from both supporters and negators of this work.

Among the few interesting observations is that unrealised wealth gains are difficult to assess (https://joindiaspora.com/posts/20937383#df8c1800ab2701399f60005056264835). This has objection has some merits, and I'd like to draw attention to it.

A tax basis should be:

- Equitable, assessed according to ability to pay.

- Certain, rather than arbitrary

- Convenien to pay

- Efficient to enact

I'm not just making these up, Adam Smith has discussion in Book V, Chapter 2, of his Wealth of Nations: https://en.wikisource.org/wiki/The_Wealth_of_Nations/Book_V/Chapter_2

Where income is at least in theory precisely denominated wealth appreciation is not transational, but is based on assumptions, notably:

- Of asset holdings themselves.

- Of the market value of those holdings.

Both are subject to uncertainty.

FIRE is Risk

For some time, I've come to view the "FIRE" sector of the economy --- finance, real estate, and insurance --- as having the common thread of risk. That is, each is based on the premise of assessing both the current market value and the associated uncertainty regarding that, of a portfolio --- debt and assets, real estate property holdings, insurance policies, respectively in each specific case. Whilst all economic activity embodies some degree of risk, it's in the FIRE sector that risk seems to be the principle, possibly only manageable component. Actors within the sector attempt risk management through diversification, information, modeling, prediction, outcomes management, expectations management, legislated liability or immunity, and direct management of both activities and entities engaged in the sector.

Notions of economic value are then inherently notions of risk. (Among numerous other confounding factors.)

The "but it's difficult to measure" argument has also been applied, for the record, to other forms of wealth accumulation common to high-net-worth (HNW) individuals, notably stock options. The response has been to note that such options clearly have some value, though the precise valuation may not be presently knowable. Because that value has a risk component.

The ... risk ... noted by the person raising this objection was that taxation of more assessible assets might result in a flight to even less readily assessed assets further compounding the problem.

Constructing a Wealth Tax

I see a few possible options here:

- Time-average asset value. If there's uncertainty in the present-year value of assets, use a rolling average (e.g., 2, 3, 5, .. , years) to asses value, and tax based on that. Future-weighting asset inflation might be discouraged by progressively taxing higher rates or quantities of appreciation --- better to realise tax on five years of 10% gains rather than a single year of 62% gains.

- Yes, asset deflation could then be applied toward tax credits. Similar logic would apply.

- Where a range of values is given, the tax basis is assessed at the high end of the range.

- Liquidity events trigger tax settlement, including arrearages, again at progressive rates. Keeping current and accurate is encouraged.

- Costs in computing taxable value and tax amount are assessed to the specific taxpayer in question, or institutions holding or facilitating such asset holding or transfers.

- A crude and old mechanism was for stamp taxes on assets of value. Implementing this in a modern age might prove difficult, but as an example , ancient Chinese paper money required stamp taxes to be recognised as legitimate, effectively a tax on holding paper wealth.

- There are a reasonably finite number of attractive asset shelters: real estate, stocks, bonds, derivatives, collectibles, and the like. Taxation of these, either in holding or transfer, increases carrying and exchange costs. Ultimately this should reduce the asset value of these investments, and return wealth to the common weal.

I'd very much like to see any substantive discussions of the strengths, weaknesses, pitfalls, and real-world behaviour of direct wealth taxation.

#TheSecretIRSFiles #IRSFiles #SecretIRSFiles #WealthTax #inequality #value #FireSector #risk #tax #taxes #inequality #ProPublica

The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

ProPublic have had a large collection of raw IRS data fall into their hands.

Taken together, it demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most. The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.

The keystone of the analysis is this:

... To capture the financial reality of the richest Americans, ProPublica undertook an analysis that has never been done before. We compared how much in taxes the 25 richest Americans paid each year to how much Forbes estimated their wealth grew in that same time period.

We’re going to call this their true tax rate.

The results are stark. According to Forbes, those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%.

It’s a completely different picture for middle-class Americans, for example, wage earners in their early 40s who have amassed a typical amount of wealth for people their age. From 2014 to 2018, such households saw their net worth expand by about $65,000 after taxes on average, mostly due to the rise in value of their homes. But because the vast bulk of their earnings were salaries, their tax bills were almost as much, nearly $62,000, over that five-year period. ...

This is a long article. Pocket estimates a 25 minute read. Please read it before commenting.

What seems to be getting labled "The Secret IRS Files" is a data-based exploration of the inequality-generating engine that is the US tax system, formed through legislation and case law (notably Eisner v. Macomer). It's a complex topic, and ProPublica's Jesse Eisinger, Jeff Ernsthausen and Paul Kiel do an excellent job of making it relatable and comprehensible.

A few points to keep in mind for discussion.

The central thesis of the article is that income-based taxation, particularly as it has evolved in the US, is an engine that grows and amplifies extreme wealth inequalities. This datum, in combination with much other work, suggests fundamental problems with the dominant economic, political, and financial paradigm. The end-result is ugly and catastrophic, as documented by authors such as Thomas Piketty (Capital in the Twenty-First Century and Capital and Ideology), Richard G. Wilkinson and Kate Pickett (Spirit Level), Branko Milanovic (The Haves and the Have-Nots), Chrystia Freeland (Plutocrats), and a tradition in economics and philosophy stretching to the dawn of history, often foundational to major world religions and belief systems.

There's an overarching fixation in virtually all tax-policy discussion to income and consumption taxes, both of which are overwhelmingly regressive, as if they were the only options. This is simply not the case, and represents a pathological case of the is-ought fallacy The notion of wealth tax is virtually never raised, and when it does appear, meets with, for some strange and inexplicable reason,[1] violent opposition. ProPublica's focus on wealth rather than income is not a misunderstanding, it is the central point of the analysis.

At the same time, the "perfect tax" of Adam Smith, David Ricardo, Henry George, and Milton Friedman, is a wealth tax in the form of a land-value tax. ProPublica don't call for this specifically, and a land-value tax is probably not a complete solution to the present dysfunction, but it's a start, and more importantly, an example of bases for taxation which extends the conventional discussion. Reading and thinking through the dynamics and issues raised in ProPublica's reporting, a few other possibilities come to mind:

- Straight-up wealth taxes, indexed to net holdings.

- Taxing interest or loans, as a percentage. (Are interests and/or loans price elastic, and what might be the effects of various tax bases, e.g., principle vs. interest vs. payment?)

- Inheritance taxes.

- Taxing all monetary transfers, including internal payments within commercial entities, or payments or credits between corporate entities (especially: shell companies).

- Differential currency grades, with issuance and expiry schedules. (This gets wonky and complicated, but would see different circulating currencies, effectively, for retail, wholesale, and financial transactions, each of which could be independently managed. It's based in part on the observation that bi- and tri-metallic currency schemes of the past often effectively achieved this, as with copper-based pence, silver-based pounds, and gold-based guineas under English/British currency, discussed at length in Adam Smith's Wealth of Nations. China at one point had stamp taxes on its paper currency, achieving much the same ends.)

- Taxing financial transactions, stock trades, issuances, grants or exercising of options and other derivatives, etc.

I'd be interested in the ideas others offer.

I'm not in the least interested in shallow dismissals or ideological diatribes.

Cory Doctorow published an excellent digest earlier today through Pluralistic, recommended reading: https://pluralistic.net/2021/06/08/leona-helmsley-was-a-pioneer/#eat-the-rich

ProPublica have a short-form highlights precis here: https://www.propublica.org/article/the-secret-irs-files-short-form-a-quick-guide-to-what-we-uncovered (7 minutes)

Notes:

- This, dear reader, is sarcasm.

#ProPublica #TheSecretIRSFiles #SecretIRSFiles #tax #taxes #irs #IncomeTax #WealthTax #DataLeaks #IrsFiles #wealth #income #inequality #JesseEisinger #JeffErnsthausen #PaulKiel