#income

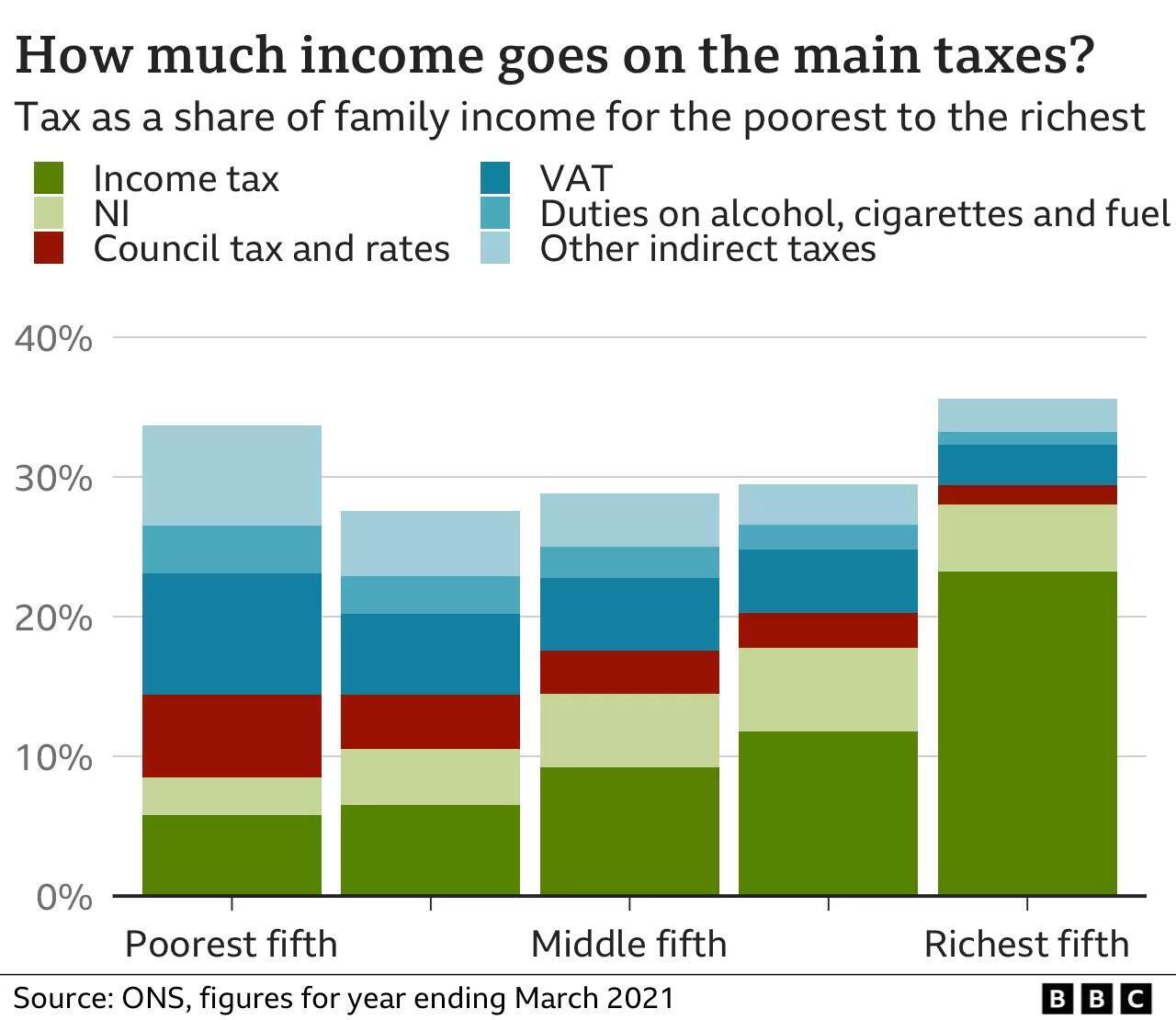

This graphic from the #BBC is telling. It shows the percentage that various income groups in the #UK pay in #tax. What can't be overlooked is how much the #poorest end up paying as a percentage of their #income. So while the richest can boast how much they are contributing in absolute terms to government services, the poor are paying nearly as much as a percentage of their already meagre spending power.

Wealth over fairness: Shocking report unveils #tax favoritism for the #rich in 41 #US #states

According to the #report, in 41 out of 50 states, the wealthiest 1 percent are subjected to lower tax rates compared to other #income groups.

Ruth Milka -January 10, 2024

..."The report contextualizes the current tax systems against the backdrop of recent trends in various states. Notably, several states have embarked on tax-cutting sprees, significantly reducing rates for #corporations and the #wealthy. This trend comes at a time when reports indicate that ultra-rich #Americans hold an estimated $8.5 trillion in untaxed assets.

In contrast to the prevailing trend, six states – California, Maine, Minnesota, New Jersey, New York, and Vermont – along with the District of Columbia, have implemented progressive tax systems. For instance, Massachusetts’ introduction of a millionaires tax led to a substantial improvement in the state’s ranking on ITEP’s Tax Inequality Index. Similarly, Minnesota has enhanced its tax policies for high earners while providing benefits for lower-income families.

Florida stands out as having the most regressive tax code in the U.S., with the wealthiest 1% paying a tax rate of only 2.7 percent, in stark contrast to the 13.2 percent rate for the poorest 20 percent. The lack of personal income taxes in Florida and similar states leads to a heavier reliance on regressive consumption and property taxes.

Recent years have seen a trend towards more regressive tax systems in many states. Kentucky, for example, has moved toward a flat tax system, resulting in significant tax cuts for higher-income families, offset by increased sales and excise taxes on a range of services and goods.

Some states are showing that tax regressivity can be addressed. New Mexico and Massachusetts have made notable progress through reforms to refundable credits and increased taxation of top earners. These efforts demonstrate the potential for policy changes to create more equitable tax systems.

The ITEP report sheds light on the pervasive issue of tax inequality across the United States. With 41 states taxing their wealthiest citizens at lower rates than other income groups, the study calls into question the fairness and effectiveness of current state tax policies. As ITEP’s Aidan Davis puts it, “The regressive state tax laws we see today are a policy choice, and it’s clear there are better choices available to lawmakers.” This conclusion underscores the need for a reevaluation of tax systems in favor of a more equitable approach."...

I have had an interesting new year and maybe its just me but patterns seem to emerge which I find interesting so I’m going to share these with anyone who cares.

I was about to embark on a great holiday around Asia until a doctor rang me and informed me that a CT scan I had just done showed I was about to die from heart failure. This was a bit of a surprise as I’m pretty fit and the only reason I did the scan was to try to find the reason for an arrhythmia I get after intense exercise.

So I stayed home in misery reading books and looking at heart problems on the internet hmmm.

Anyway the book I read was The Fate of Civilization by Michael Hudson and as I read it and read about heart health I saw a common theme

I have not delved to much into health just no smoking, fit, moderate diet but as I dived into the heart I found out about Nitic oxide. You might know about it but I didn’t. Nitric oxide is produced by the bacteria in the mouth and stomach as well as within the body by various processes and it is a key component in health from circulation to the immune system

When they discovered my heart condition I was prescribe aspirin and an anticoagulant, statins, beta blockers and a vascular dilation drug. Each one of these drugs either sapped my energy, ruined my sleep, upset my stomach, made me anxious or upset my heart rhythm. I actually felt terrible even though this was for my health.

To top it of each one of these drugs inhibited the formation of nitric oxide.

In The Fate of Civilization Michael Hudson showed that it was unearned income that is destroying our economy and society as well as our ability to save our environment. There are a lot of things around this such as debt and the belief that all debt must be paid but this all revolved around the belief that unearned income was a legitimate income and the ability to extract this must be protected.

The extraction of unearned income in the form of rents, interest, resource use and intellectual property is the major cause of our wealth disparity, it is the reason countries are kept in poverty and why our environment is degraded.

So what do nitric oxide and unearned income have in common?

I have heard no discussion of either of these topics outside of the alternative media. I go to my doctor, do a blood test and am offered statins which are an industrial solution to a problem caused by the industrial nature of our food. I will have a stent which is more industrial solutions and each one adds to GDP. My ill health creates economic benefit according to economists but it is the industrial system and those who own this system who benefit.

With unearned income in the form of rents or interest people are made poorer, demand declines and the countries debt expands, the solution we are told is austerity or a reduction in public services or privatization of our resources. These are the solutions proposed by those who have extracted the unearned income form our countries and their solutions will only benefit them again.

You might say I was told to eat my greens but to be honest I never realised why or the process involved from the greens to my health, I was never told about the role Nitic oxide played and maybe its because my doctor was never taught. This is the same as our economy, most of our economists have probably never heard of unearned income as they are taught all income is earned.

I then read this article about our duty to speak honestly. Now totalitarianism might be some distance from nitric oxide but it is closely linked to unearned income as this is the key that puts the one percent in the one percent.

So read or listen to Michael Hudson and learn about unearned income and talk about unearned income to anyone and everyone. We need to make it part of our language. Oh and don’t forget to eat your kale and beets you need a healthy heart to keep the conversation going.

cheers

here’s a link to Michaels site to

I forgot my hash tags

#economics #money #power #war #inequality #income #rent #manipulation #hearthealth #nitricoxide

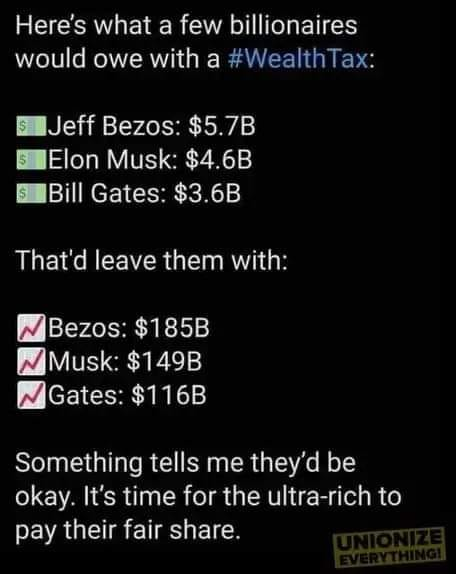

Wealth Tax Chart

#wealthy #rich #SaveTheRich #CapitalismFail #income #tax #WealthTax #CorporateTerrorism

Jeremy #Corbyn is a #multimillionaire with an income 461% more than the #UK average. He comes from #wealth & lives in Finsbury Park where the average house price is 263% above the UK #average & the #median #household #income is 50% above the UK average.

Corbyn is a champagne #socialist & his wealth insulates him from every negative aspect of the mass #migration he advocates for.

Mass migration stagnates #wages, drives up #rent & house prices, puts additional demand on #infrastructure & social services & leads to ethno-linguistic fragmentation of autochthonous #British cultures.

#jeremycorbyn #champagnesocialist #usa #hypocrisy #labourparty #leftwinghypocrisy #leftwingelitists #londonelites #elitism #richmennorthofrichmond #plutocracy #westminsterbubble #globalism

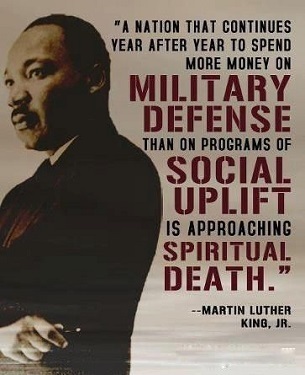

Martin Luther King Jr. ~ A True and Visionary Radical

January15,1929 - April 4,1968

As we celebrate #Martin-Luther-King-Jr-Day, let’s look at some of the things he said that challenged #capitalism and are left out of most history books.

“I imagine you already know that I am much more #socialistic in my economic theory than capitalistic… Capitalism started out with a noble and high motive… but like most human systems it fell victim to the very thing it was revolting against. So today capitalism has out-lived its usefulness.”

Letter to Coretta Scott, July 18, 1952.

“In a sense, you could say we’re involved in the #class-struggle.”

-Quote to New York Times reporter, Jose Igelsias, 1968.

“And one day we must ask the question, ‘Why are there forty million poor people in America? And when you begin to ask that question, you are raising questions about the #economic-system, about a broader distribution of wealth.’ When you ask that question, you begin to question the capitalistic economy. And I’m simply saying that more and more, we’ve got to begin to ask questions about the whole #society…”

-Speech to Southern Christian Leadership Conference Atlanta, Georgia, August 16, 1967.

“Capitalism forgets that #life-is-social. And the kingdom of brotherhood is found neither in the thesis of communism nor the antithesis of capitalism, but in a higher synthesis.”

-Speech to Southern Christian Leadership Conference Atlanta, Georgia, August 16, 1967.

“Call it #democracy, or call it #democratic-socialism, but there must be a better distribution of wealth within this country for all God’s children.”

Speech to the Negro American Labor Council, 1961.

“We must recognize that we can’t solve our problem now until there is a radical #redistribution of #economic and #political #power… this means a #revolution of #values and other things. We must see now that the evils of #racism, economic #exploitation and #militarism are all tied together… you can’t really get rid of one without getting rid of the others… the whole structure of American life must be changed. America is a #hypocritical nation and we must put our own house in order.”

Report to SCLC Staff, May 1967.

“The evils of #capitalism are as real as the evils of #militarism and evils of #racism.”

-Speech to SCLC Board, March 30, 1967.

“I am now convinced that the simplest approach will prove to be the most effective - the solution to poverty is to abolish it directly by a now widely discussed matter: the #guaranteed #income… The curse of poverty has no justification in our age. It is socially as cruel and blind as the practice of cannibalism at the dawn of civilization, when men ate each other because they had not yet learned to take food from the soil or to consume the abundant animal life around them. The time has come for us to civilize ourselves by the total, direct and immediate #abolition-of-poverty.”

Where do We Go from Here?,1967.

“You can’t talk about solving the economic problem of the Negro without talking about billions of dollars. You can’t talk about ending the slums without first saying #profit must be taken out of slums. You’re really tampering and getting on dangerous ground because you are messing with folk then. You are messing with captains of industry. Now this means that we are treading in difficult water, because it really means that we are saying that something is wrong with capitalism.”

Speech to his staff, 1966.

“We are saying that something is wrong … with capitalism… There must be better distribution of wealth and maybe America must move toward a democratic socialism.”

Speech to his staff, 1966.

“If America does not use her vast resources of wealth to end poverty and make it possible for all of God’s children to have the basic necessities of #life, she too will go to hell.”

Speech at Bishop Charles Mason Temple of the Church of God in Christ in support of the Memphis sanitation workers’ strike on March 18th, 1968, two weeks before he was assassinated.

#mlk #mlkday #martinlutherkingjr #civilrights

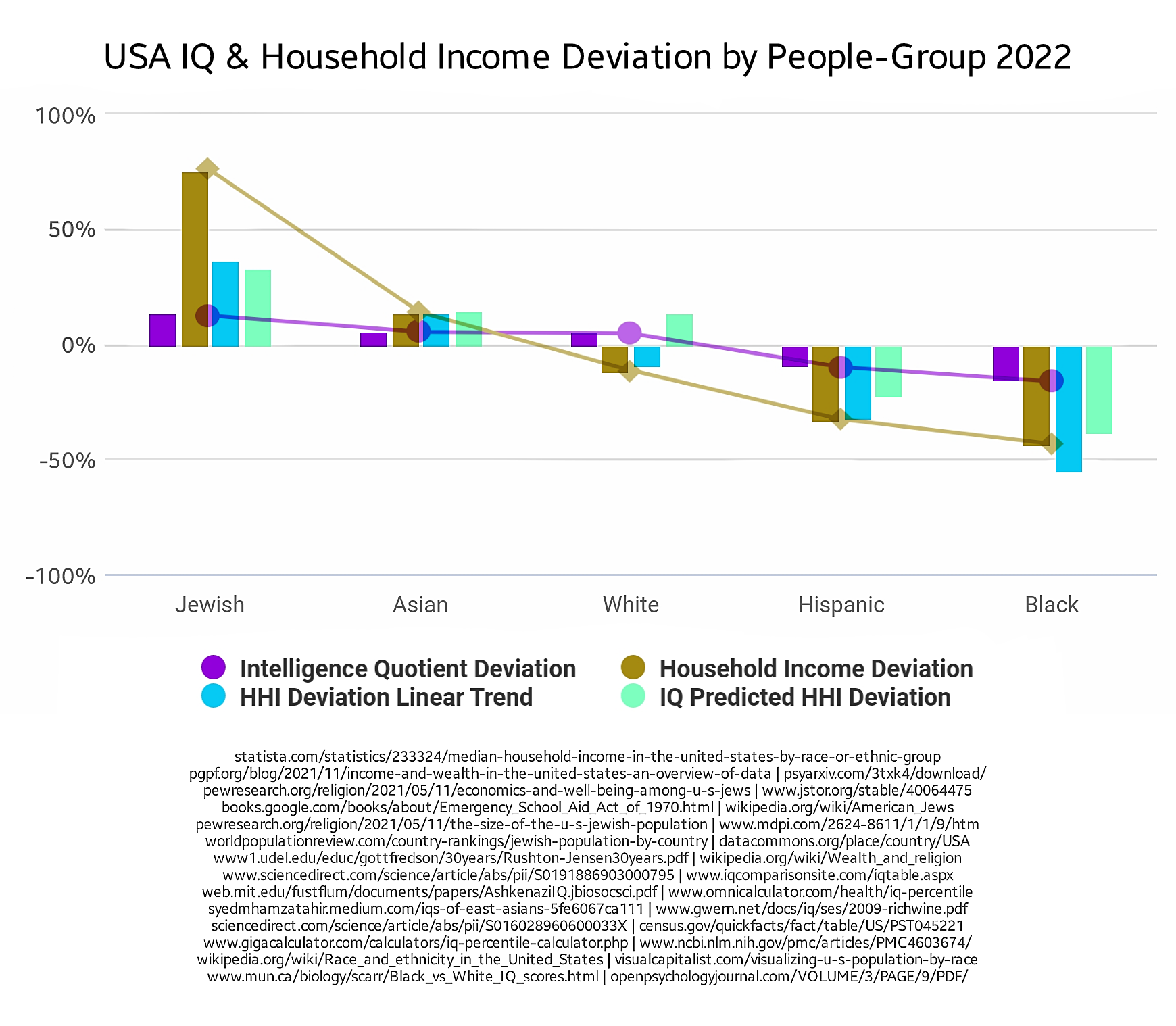

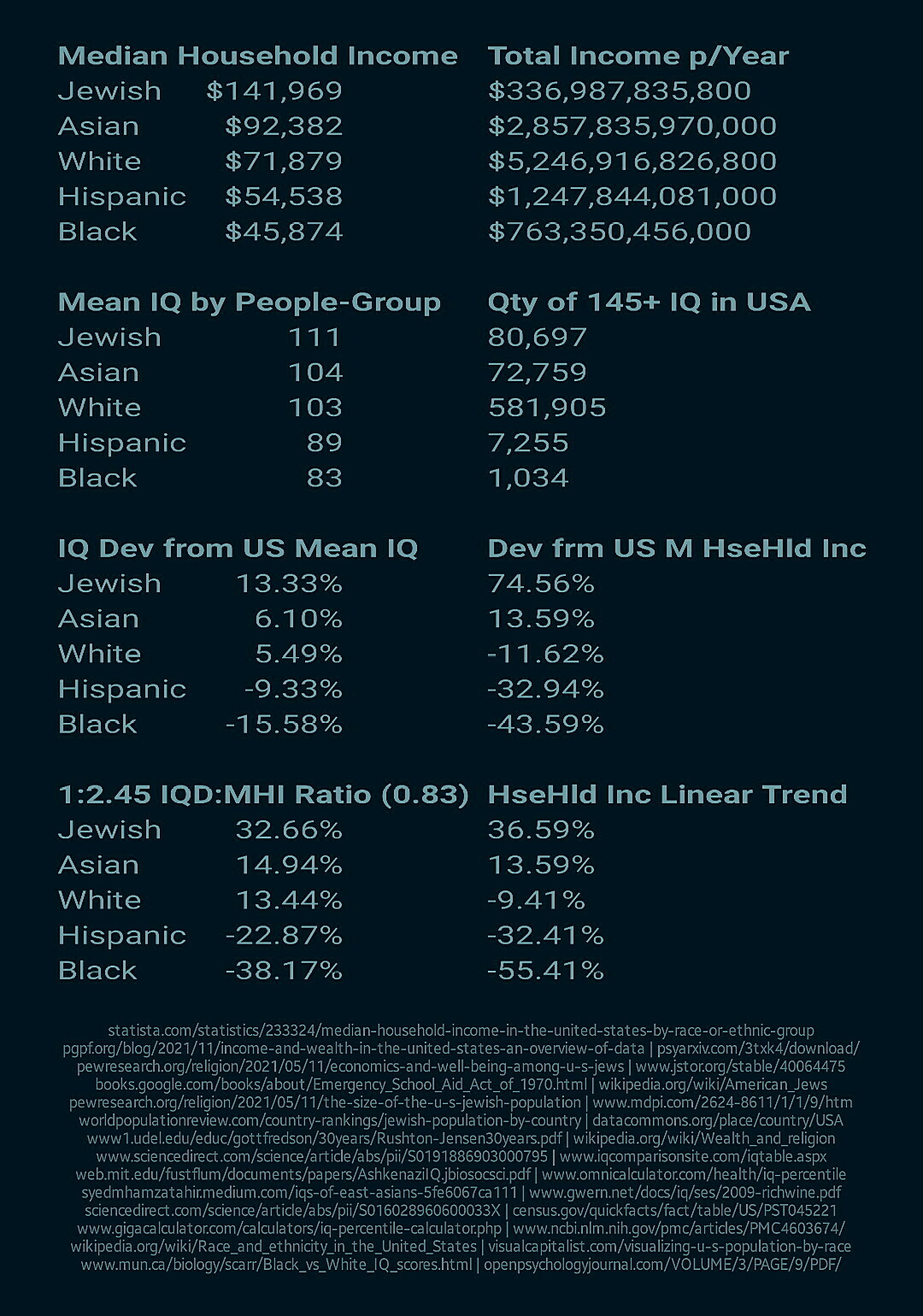

USA IQ & Household Income Deviation by People-Group 2022.

#usa #demographics #ethnography #iq #intelligence #intelligencequotient #intellectualability #ethnicity #race #peoplegroups #ethnolinguistics #statistics #stats #data #graph #chart #information #jewish #jews #afroasiatic #asian #asiatic #white #indoeuropean #european #hispanic #southamerican #black #african #africanamerican #householdincome #medianhouseholdincome #money #anthropology #sociology #income #economics #socioeconomics

April looks like it was just the start of our sense of “everything we think might be wrong” being set into hyperdrive.

#stock-market #economy #income #spending #earnings #USA #economy #UK

Blain’s Morning Porridge April 29 2022 – The Penny Drops: April Exposes Markets to Some Brutal Truths. Reality Bites.

The Economic Mistake Democrats Are Finally Confronting

#unitedstateseconomy #unitedstatespoliticsandgovernment #democraticparty #unitedstates #pricesfaresfeesandrates #inflationeconomics #rationingandallocationofresources #niskanencenter #welfareus #income #economicconditionsandtrends #economicstheoryandphilosophy #liberalismuspolitics #publicandsubsidizedhousing #bidenjosephrjr #news

To counter U.S. hostility, China moves towards people centered policies

To counter #China, the #USA shifts to the #oligarchy. To counter #America, China shifts to the #people. Who will win?

Aside from the #ideological #underpinning, the new regulatory moves are #populist. The #masses will like them. They guarantee #President #XiJinping's #reelection at next year's national party congress. They will #strengthen China's #unity in its #competition with the #UnitedStates.

#MoonOfAlabama #MoA #globalization #economic #fundamentals #free-markets #income #disparity #investment #mgmt #legal #politics #regulations #regulators #soros #michaelhudson #healthy #society #common #prosperity

Quit the Rat Race

Adopt a don't work ethic.

China now has a Lying Flat movement.

The idea is not to be a productive citizen. Don't work any harder than you have to. Don't help stockholders and bankers. Don't contribute to the GDP.

I've read that slaveholders in what's now Haiti were afraid that, if they freed their slaves, they wouldn't be able to pay them to keep working for their former slaveholders. They were afraid they'd take to the hills and forage or engage in subsistence farming. In other words, they were afraid that the former slaves would produce only what they needed, and nothing would be left over for the land owners.

This is what the authorities in China are worried about now. They don't want people to reduce their cost of living in order to be able to earn less, they want them to increase their cost of living, forcing them to work harder and longer. They want them to stay in the rat race. They want them to be in debt.

Reducing our cost of living to be able to lower our income has other advantages.

The only way to do anything useful about the on-going climate catastrophe is to reduce consumption of everything, and to reduce the amount of transportation, both of people and of other things.

The on-going climate catastrophe is only one (probably the most dangerous) of the symptoms of wealth and income inequality. Quitting the rat race is perhaps the most effective way to attack this central problem. The billionaires get all their income directly and indirectly from selling people goods and services they would be better off without. What will happen to Tim Cook if no one will buy a new Apple product? The wealthiest people in the world are those who peddle the most harmful goods and services.

- Buy durable clothing, and keep on wearing it, year after year.

- Keep on using your present computers. This is practical because there are Linux distros made especially for old machines. Other distros will have better support for old machines if we stop buying new ones.

- For all devices, mechanical and electronic, buy the most durable and reliable.

- Rent living space, and don't rent more than you need. Mortgages are a huge part of the banking business.

- Live as close as possible to the grocery store. It's best if we can walk to the store.

- Buy a motor scooter, preferably for cash. It's less expensive to buy, insure, and operate. The Japanese ones tend to be the most durable and maintenance-free.

- Better yet, if you live close enough to the grocery store, buy a bicycle instead.

- Eat vegan. It's less expensive, and it puts less land under agricultural use.

- Often, in the supermarket, the best value is on the bottom shelf. Always look.

- Wash your hair with the same inexpensive soap you wash the rest of your body with. Use that same soap for shaving.

- If you have a beard, don't shave it. Just trim it with scissors.

- Don't print stuff. Printers are a huge rip-off.

- Don't be a tourist. Tourism is a huge and entirely unnecessary industry that requires transportation.

- Don't get more medical care than you need. You need a lot less than the health care industry says you need.

So, once again, the goal is to reduce your cost of living, and not increase your income. Refusing to work full time for wages will kill the same industries that we're killing anyway by not buying what they sell. I look forward to a world that has fewer people, and is much quieter. I don't want to stop science, but I do want to stop the patenting of inventions. I also want culture to be free. Let's completely abandon the idea of intellectual property.

What else?

Well, if you spend less of your life toiling for the wealthy in order to sell unhealthy crap to people, and more time learning, napping, reading books, and listening to old records, you'll probably be happier and live longer.

http://www.zpub.com/notes/idle.html In Praise of Idleness, by Bertrand Russell

#laziness #work #rat-race #leisure #income #bankers #wealthy #billionaires #gdp #lying-flat #idleness #happiness #inequality #markets #buying #buy-less

Who is not vaccinated in the US? - Vox

Vaccines are the strongest bulwark against the Covid-19 pandemic. They’re highly effective at preventing deaths and hospitalizations, free in the US, and all residents over the age of 12 are eligible. But even with the highly transmissible delta variant gaining ground and new Covid-19 cases on the rise, vaccinations have reached a stubborn plateau. About 67 percent of eligible US residents have received at least one dose, and the rate of new vaccinations has fallen drastically since the spring. From a peak of 3.4 million shots per day in April, the number of daily new injections is down to around 600,000.

Revisiting the Marshmallow Test: A Conceptual Replication Investigating Links Between Early Delay of Gratification and Later Outcomes - Tyler W. Watts, Greg J. Duncan, Haonan Quan, 2018

We replicated and extended Shoda, Mischel, and Peake’s (1990) famous marshmallow study, which showed strong bivariate correlations between a child’s ability to delay gratification just before entering school and both adolescent achievement and socioemotional behaviors. Concentrating on children whose mothers had not completed college, we found that an additional minute waited at age 4 predicted a gain of approximately one tenth of a standard deviation in achievement at age 15. But this bivariate correlation was only half the size of those reported in the original studies and was reduced by two thirds in the presence of controls for family background, early cognitive ability, and the home environment. Most of the variation in adolescent achievement came from being able to wait at least 20 s. Associations between delay time and measures of behavioral outcomes at age 15 were much smaller and rarely statistically significant.

https://journals.sagepub.com/doi/abs/10.1177/0956797618761661

The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

ProPublic have had a large collection of raw IRS data fall into their hands.

Taken together, it demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most. The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.

The keystone of the analysis is this:

... To capture the financial reality of the richest Americans, ProPublica undertook an analysis that has never been done before. We compared how much in taxes the 25 richest Americans paid each year to how much Forbes estimated their wealth grew in that same time period.

We’re going to call this their true tax rate.

The results are stark. According to Forbes, those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%.

It’s a completely different picture for middle-class Americans, for example, wage earners in their early 40s who have amassed a typical amount of wealth for people their age. From 2014 to 2018, such households saw their net worth expand by about $65,000 after taxes on average, mostly due to the rise in value of their homes. But because the vast bulk of their earnings were salaries, their tax bills were almost as much, nearly $62,000, over that five-year period. ...

This is a long article. Pocket estimates a 25 minute read. Please read it before commenting.

What seems to be getting labled "The Secret IRS Files" is a data-based exploration of the inequality-generating engine that is the US tax system, formed through legislation and case law (notably Eisner v. Macomer). It's a complex topic, and ProPublica's Jesse Eisinger, Jeff Ernsthausen and Paul Kiel do an excellent job of making it relatable and comprehensible.

A few points to keep in mind for discussion.

The central thesis of the article is that income-based taxation, particularly as it has evolved in the US, is an engine that grows and amplifies extreme wealth inequalities. This datum, in combination with much other work, suggests fundamental problems with the dominant economic, political, and financial paradigm. The end-result is ugly and catastrophic, as documented by authors such as Thomas Piketty (Capital in the Twenty-First Century and Capital and Ideology), Richard G. Wilkinson and Kate Pickett (Spirit Level), Branko Milanovic (The Haves and the Have-Nots), Chrystia Freeland (Plutocrats), and a tradition in economics and philosophy stretching to the dawn of history, often foundational to major world religions and belief systems.

There's an overarching fixation in virtually all tax-policy discussion to income and consumption taxes, both of which are overwhelmingly regressive, as if they were the only options. This is simply not the case, and represents a pathological case of the is-ought fallacy The notion of wealth tax is virtually never raised, and when it does appear, meets with, for some strange and inexplicable reason,[1] violent opposition. ProPublica's focus on wealth rather than income is not a misunderstanding, it is the central point of the analysis.

At the same time, the "perfect tax" of Adam Smith, David Ricardo, Henry George, and Milton Friedman, is a wealth tax in the form of a land-value tax. ProPublica don't call for this specifically, and a land-value tax is probably not a complete solution to the present dysfunction, but it's a start, and more importantly, an example of bases for taxation which extends the conventional discussion. Reading and thinking through the dynamics and issues raised in ProPublica's reporting, a few other possibilities come to mind:

- Straight-up wealth taxes, indexed to net holdings.

- Taxing interest or loans, as a percentage. (Are interests and/or loans price elastic, and what might be the effects of various tax bases, e.g., principle vs. interest vs. payment?)

- Inheritance taxes.

- Taxing all monetary transfers, including internal payments within commercial entities, or payments or credits between corporate entities (especially: shell companies).

- Differential currency grades, with issuance and expiry schedules. (This gets wonky and complicated, but would see different circulating currencies, effectively, for retail, wholesale, and financial transactions, each of which could be independently managed. It's based in part on the observation that bi- and tri-metallic currency schemes of the past often effectively achieved this, as with copper-based pence, silver-based pounds, and gold-based guineas under English/British currency, discussed at length in Adam Smith's Wealth of Nations. China at one point had stamp taxes on its paper currency, achieving much the same ends.)

- Taxing financial transactions, stock trades, issuances, grants or exercising of options and other derivatives, etc.

I'd be interested in the ideas others offer.

I'm not in the least interested in shallow dismissals or ideological diatribes.

Cory Doctorow published an excellent digest earlier today through Pluralistic, recommended reading: https://pluralistic.net/2021/06/08/leona-helmsley-was-a-pioneer/#eat-the-rich

ProPublica have a short-form highlights precis here: https://www.propublica.org/article/the-secret-irs-files-short-form-a-quick-guide-to-what-we-uncovered (7 minutes)

Notes:

- This, dear reader, is sarcasm.

#ProPublica #TheSecretIRSFiles #SecretIRSFiles #tax #taxes #irs #IncomeTax #WealthTax #DataLeaks #IrsFiles #wealth #income #inequality #JesseEisinger #JeffErnsthausen #PaulKiel