"Predictably Bad Investments: Evidence from venture capitalists" by Diag Davenport. This is from 2 years ago but I just found out about it today. So this guy created a machine learning model on a venture capital database, and found the machine learning model was able to predict the successes. Not perfectly, but probabilistically, and better than the alternatives -- he runs a comparison with the bond market and S&P 500 stocks.

The VC database is called Pitchbook.

"Pitchbook is a subscription data provider widely used by investors for information on deals, companies, and other investors in private capital markets." "There are three categories of information that I synthesize from the Pitchbook data: finances (e.g., Revenue, EBITDA, total capital raised), founder information (e.g., educational background and previous experience), and company/product description."

"I begin by identifying every startup that participated in any of the top 100 accelerator and incubator programs between 2009 and 2016. Many of the companies will be familiar to the reader and include Airbnb, Doordash, Stripe, Dropbox, Coinbase, Instacart, and Uber. For each of those 16,054 firms, I then construct a dataset of all equity deals known to Pitchbook within the first five years of completing their accelerator program. One key motivation for pre-defining a set of firms of interest and then following their valuations over time is to avoid any survivorship bias which would severely limit the interpretation of any results."

"Accelerators are seen as a launch pad for many startups. The key statistic is the sum of the post-money valuations for firms launched from a given accelerator. The top two (Rocketspace and Y Combinator) support several common, though conflicting intuitions about startup investing. First, Rocketspace, while only investing in 3 companies in my data, is ranked at the top. Its sole non-zero investment is Uber. This supports the notion that one right-tail outlier can define the performance of the entire portfolio. The second investor in the table is Y Combinator which has a much broader scope, investing in over 400 companies over the course of my data. These two investors together account for over 70% of the market value of companies in my data."

"The names of the investors in the top firms will be familiar to practitioners: Benchmark, Seqouia, and Accel. These firms again appear to have some ability to discern since they make up relatively small shares of total investment, but comprise outsized shares of market value of portfolio companies. For example, Sequoia Capital only makes up 1% of invested early-stage equity in my data, but its portfolio companies make up 6% of market value in my data."

"Early-stage investment" is defined (more or less) as "any equity deal in the Pitchbook data within two years of incubator completion that is categorized as 'Series A', 'Series B', 'Seed Round', or 'Angel (Individual)' in the Deal Type."

"Late-stage exit" is defined (more or less) as "initial public offering (IPO), merger or acquisition (MA), or any funding round that is categorized by Pitchbook as Series C or later (C+) within five years of accelerator completion."

He doesn't reveal anything about the machine learning model, but claims it worked.

"The algorithm has found signal. That startup success is predictable at all creates scope for savvy investors to have persistent returns which remains an outstanding question in the literature."

However, when he looks at "failure", as defined by "bankruptcy declaration" or "documented shut down", he finds, "no clear relationship between the firm's predicted success and its probability of failing." I took this to mean that success and failure are asymmetric: it takes a long string of many successes events to make a successful firm, but only one failure event to make a failure firm -- but no, he attributes this aspect of the data to the idea that the failure of many firms is not observed. He says if there is a high expectation that a firm will be successful, then news of its failure (through either "bankruptcy declaration" or "documented shut down") is more likely to be observed and included in the database.

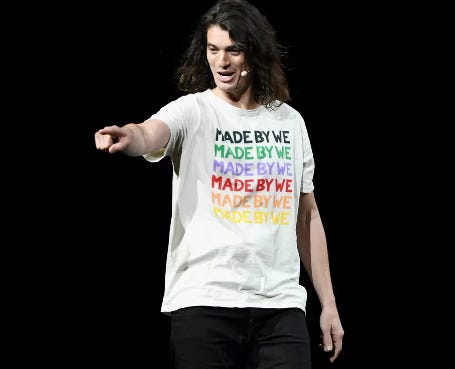

So what explains VCs mistakes? He thinks the major factor is having too much confidence in people and too little in product.

"Despite the fact that none of the coefficients carry causal interpretations, there are several suggestive takeaways. First, nearly all points lie directly on the axes, suggesting that firms use totally different criteria when selecting good and bad investments. Second, the word tokens along the vertical axis appear to differ systematically from those along the horizontal axis -- the model trained on the worst firms appears to prioritize founder details, whereas the model trained on the best firms appears to prioritize product details. When making good investments, investors appear to bet on the horse, but when making bad investments they appear to be betting on the jockey."

"Business icons from Ray Kroc to Jeff Bezos have captured our attention and lend credence to the mythology surrounding founders and their startups. Hit TV shows such as 'Shark Tank' and industry norms around 'Pitch Day' events suggest an ethos built around founder charisma and personal persuasion. In his best-selling book 'Good to Great', Collins (2009) asserts 'First Who, Then What' and the idea has been absorbed into the zeitgeist." "Investors seem convinced that the founder-first model of the world is the correct one."

Predictably Bad Investments: Evidence from venture capitalists

#solidstatelife #startups #venturecapital #vc