A Manifesto Against For-Profit Health Insurance Companies — by Michael Moore

I hereby give you my Oscar-nominated Documentary on the Killer Health Insurance companies like United HealthCare —SICKO — for FREE… and let’s end and replace this so-called “health care system” NOW. (...)

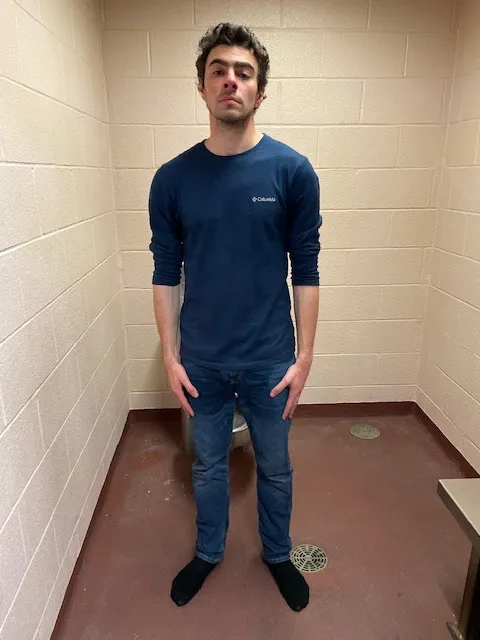

(Text continues underneath the photo.)

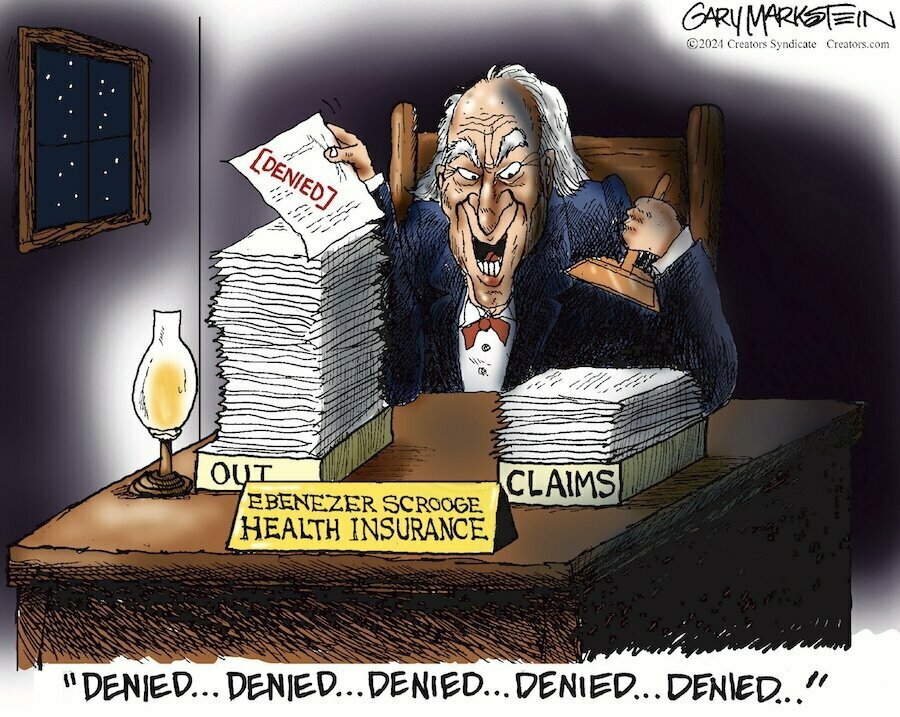

Here’s a sad statistic for you: In the United States, we have a whopping 1.4 million people employed with the job of DENYING HEALTH CARE, vs only 1 million doctors in the entire country! That’s all you need to know about America. We pay more people to deny care than to give it. 1 million doctors to give care, 1.4 million brutes in cubicles doing their best to stop doctors from giving that care. If the purpose of “health care” is to keep people alive, then what is the purpose of DENYING PEOPLE HEALTH CARE? Other than to kill them? I definitely condemn that kind of murder. And in fact, I already did. In 2007, I made a film – SICKO – about America’s bloodthirsty, profit-driven and murderous health insurance system. It was nominated for an Oscar. It’s the second-largest grossing film of my career (after Fahrenheit 9/11). And over the past 15 years, millions upon millions of people have watched it including, apparently, Luigi Mangione. (...)

Tags: #english #us #united_states #health_care #health_insurance #insurance #luigi_mangione #for_profit #sicko #michael_moore