#tax

they are so proud of being completely evil

https://twitchy.com/amy-curtis/2024/12/06/uk-just-incentivized-killing-grandma-n2404775

That Didn’t Take Long: Days After Passing #Assisted #Dying Law, #UK. #Tax #Plan #Incentivizes #Death by Age 75

https://old.bitchute.com/video/nych4i0PT9SL/

its a war on nature is a war on god its a war on all of us

#WE ARE THE #LAND - UK #Farmers Protesting Against the Inheritance #Tax

#Tax on the super-rich approved in #G20 leaders' #declaration

"With full respect for tax sovereignty, we will seek to engage cooperatively to ensure that ultra-high-net-worth individuals are effectively taxed. Cooperation may include exchanging best practices, fostering debates on tax principles, and developing anti-avoidance mechanisms, such as addressing potentially harmful tax practices. We look forward to continuing discussions on these issues within the G20 and other relevant forums, drawing on the technical contributions of international organizations, universities, and experts," says the document, whose final content was approved by consensus.

#politics #wealth #rich #future #finance #economy #money #news #poverty

#UK: #Royal estates 'receive millions from public bodies and charities'

Source: https://www.bbc.com/news/articles/cg4l1lzv2nro

In the investigation by Channel 4’s Dispatches and the Sunday Times, it is reported that the private estates of King Charles and Prince William hold contracts with public bodies and charities.

#crown #England #money #finance #Royal #tax #politics #economy #news #scandal #charity #Problem #Democracy #justice

Swedish taxes explained using Danish bricks

But the principle applies to all countries, only the degree of severity varies

#inequality #tax

Brazilian #Tax Watchdog Uses #AI Tool to Identify Operations Linked to Over $180 Million in #Crypto - Related Tax #Fraud

#Apple Must Pay $14.4 Billion to #Ireland in Crackdown On ‘Sweetheart Deals’

Source: https://www.wired.com/story/apples-tax-bust-up-in-ireland-is-a-warning-to-big-tech/

Apple has been ordered to pay €13 billion ($14.4bn) of unpaid #taxes to the Irish state, in a #court ruling that ended a decade-long fight between #Europe and the big tech company.

If they cannot get you to agree to being the all-caps #name, they have a problem

Court jurisdiction is everything in the legal system, especially for a living man. If they cannot get you to agree to being the all-caps name, the legal fiction, they is a problem. I am joined by Mick Butler who has been pushing back against the system for three years on council #tax.

https://www.youtube.com/watch?v=kbJ97MsXxls

here comes the #taxman

https://www.bitchute.com/video/PAJpiQnmwLw3/

SHARE THIS! LIKE A CRAZY EX #CALIFORNIA PLANS TO TAG, TRACK, & #TAX #DRIVERS FOR #EVERY #MILE THEY

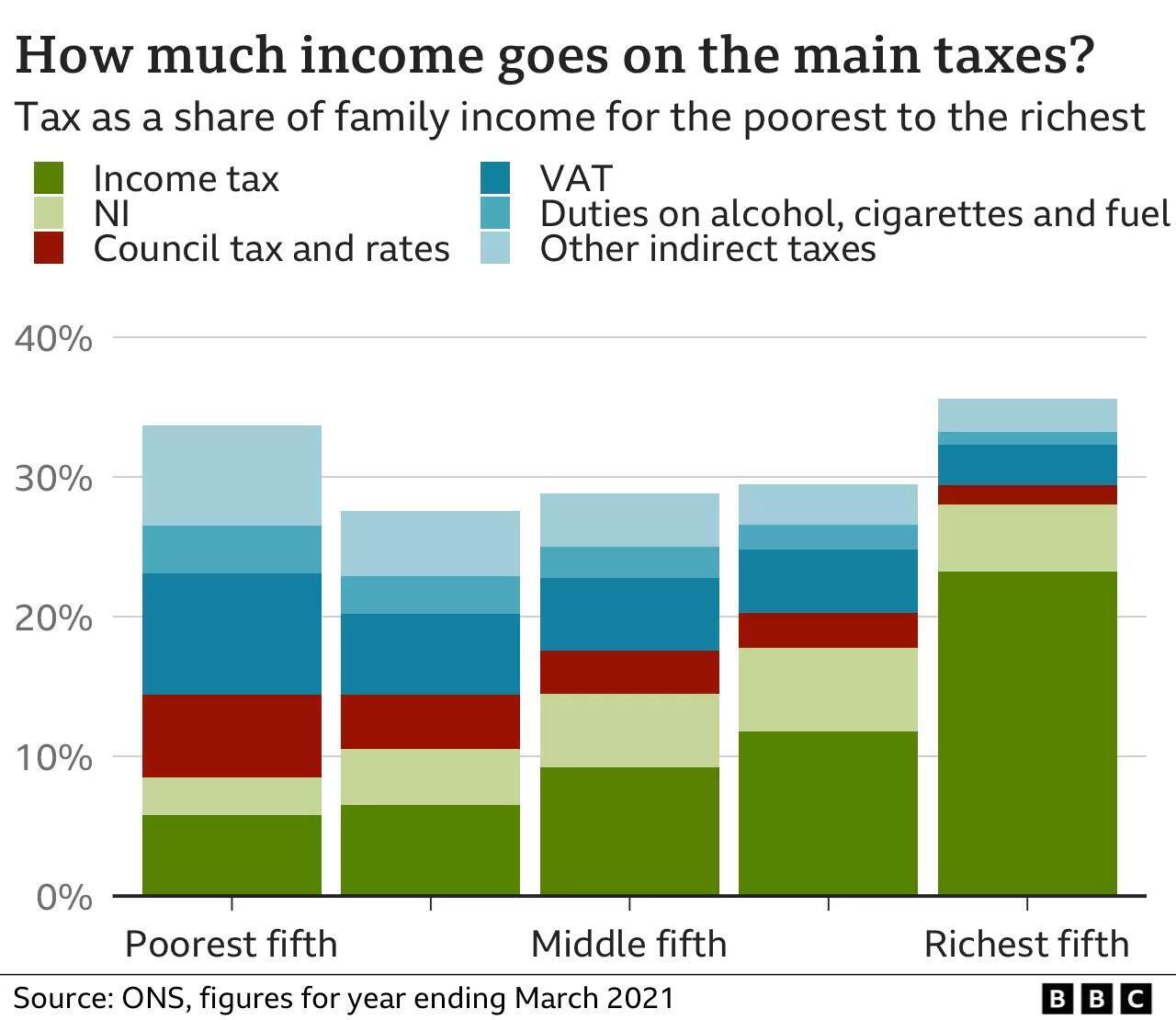

This graphic from the #BBC is telling. It shows the percentage that various income groups in the #UK pay in #tax. What can't be overlooked is how much the #poorest end up paying as a percentage of their #income. So while the richest can boast how much they are contributing in absolute terms to government services, the poor are paying nearly as much as a percentage of their already meagre spending power.

Google routinely evades tax by moving capitals to Bermuda,

and moving their EU profits to their Dutch or Irish companies. Over the years, it’s an estimate of 60 Billions $ that Google may have moved to Bermuda (20Billion Euros for the year 2017 alone!).

Google Chairman Eric Schmidt has claimed that [evading taxes in UK] is “capitalism” and that he was “very proud” of it.

“Google has been fined 2.42bn euros by the European Commission after it ruled the company had abused its power

by promoting its own shopping comparison service at the top of search results.” Yet while this amount of a fine -the largest by the EU- seems ridiculous in comparison to the companies’ profits (about 300M$ per day!) several EU investigations do not seem to advance very fast.

#HMRC has not charged a single company over #TaxEvasion under landmark #legislation | HMRC | The Guardian

Wealth over fairness: Shocking report unveils #tax favoritism for the #rich in 41 #US #states

According to the #report, in 41 out of 50 states, the wealthiest 1 percent are subjected to lower tax rates compared to other #income groups.

Ruth Milka -January 10, 2024

..."The report contextualizes the current tax systems against the backdrop of recent trends in various states. Notably, several states have embarked on tax-cutting sprees, significantly reducing rates for #corporations and the #wealthy. This trend comes at a time when reports indicate that ultra-rich #Americans hold an estimated $8.5 trillion in untaxed assets.

In contrast to the prevailing trend, six states – California, Maine, Minnesota, New Jersey, New York, and Vermont – along with the District of Columbia, have implemented progressive tax systems. For instance, Massachusetts’ introduction of a millionaires tax led to a substantial improvement in the state’s ranking on ITEP’s Tax Inequality Index. Similarly, Minnesota has enhanced its tax policies for high earners while providing benefits for lower-income families.

Florida stands out as having the most regressive tax code in the U.S., with the wealthiest 1% paying a tax rate of only 2.7 percent, in stark contrast to the 13.2 percent rate for the poorest 20 percent. The lack of personal income taxes in Florida and similar states leads to a heavier reliance on regressive consumption and property taxes.

Recent years have seen a trend towards more regressive tax systems in many states. Kentucky, for example, has moved toward a flat tax system, resulting in significant tax cuts for higher-income families, offset by increased sales and excise taxes on a range of services and goods.

Some states are showing that tax regressivity can be addressed. New Mexico and Massachusetts have made notable progress through reforms to refundable credits and increased taxation of top earners. These efforts demonstrate the potential for policy changes to create more equitable tax systems.

The ITEP report sheds light on the pervasive issue of tax inequality across the United States. With 41 states taxing their wealthiest citizens at lower rates than other income groups, the study calls into question the fairness and effectiveness of current state tax policies. As ITEP’s Aidan Davis puts it, “The regressive state tax laws we see today are a policy choice, and it’s clear there are better choices available to lawmakers.” This conclusion underscores the need for a reevaluation of tax systems in favor of a more equitable approach."...

Why is President Ruto in a row with Kenya’s judiciary? A simple guide

The president's outbursts come after a series of rulings against his reforms since he took office in August 2022.#Courts #Tax #Africa #Kenya

Why is President Ruto in a row with Kenya’s judiciary? A simple guide

More money, more problems: Debate on Black Tax in African football returns

For footballers, 'Black Tax' has become endemic but the matter has usually been discussed in hushed tones or privately.#Features #Sports #Football #Tax #Africa

More money, more problems: Debate on Black Tax in African football returns

World's #billionaires pay only 0.5% in #taxes, says report...

#capitalism #news #justice #politics #tax #fail #problem #billionaire #money #finance

Tell your #senators to become original #co-sponsors of the #Billionaires Income #Tax

"Next week, Senate Finance Committee Chair Ron Wyden (D-OR) is widely expected to introduce his Billionaires Income Tax (BIT) to correct the absurdity of billionaires paying lower tax rates than many working people.

According to the Joint Committee on Taxation, the BIT would raise $557 billion over 10 years.[4] It would be applied annually to the growth in value of easily priced assets such as stocks, and to the growth in value of harder to price assets like private businesses when they’re sold.

This new tax would only apply to taxpayers whose net worth either exceeds $1 billion or whose income exceeds $100 million for three consecutive years.

This is a critical piece of legislation that would not only ensure that America’s 748 billionaires are paying income taxes each year―just like working people do―it would also help close the widening wealth gap in America: the richest 1% hold almost one-third (31%) of U.S. wealth while the bottom 50% has just 2.5%.

Click “START WRITING” to send a message to your U.S. senators urging them to become original co-sponsors of the Billionaires Income Tax to ensure billionaires start paying their fair share of taxes."