PS : Au passage, cette vidéo, comme d'autres sont hébergé sur ma nouvelle chaine #peertube 1000iTemps dont voici la raison d'être :

End:Civ est un #film #documentaire réalisé par Franklin Lopez, qui examine le caractère #destructeur et #autodestructeur de la #civilisation #industrielle, sur le plan #écologique, ainsi que son caractère hautement #coercitif, sur le plan #social. Basé en partie sur Endgame, un best-seller écrit par Derrick Jensen, End:Civ demande : « Si ton pays se faisait envahir par des extraterrestres qui coupaient les forêts, qui empoisonnaient l’eau et l’air et contaminaient les réserves de nourriture, résisterais-tu ? »

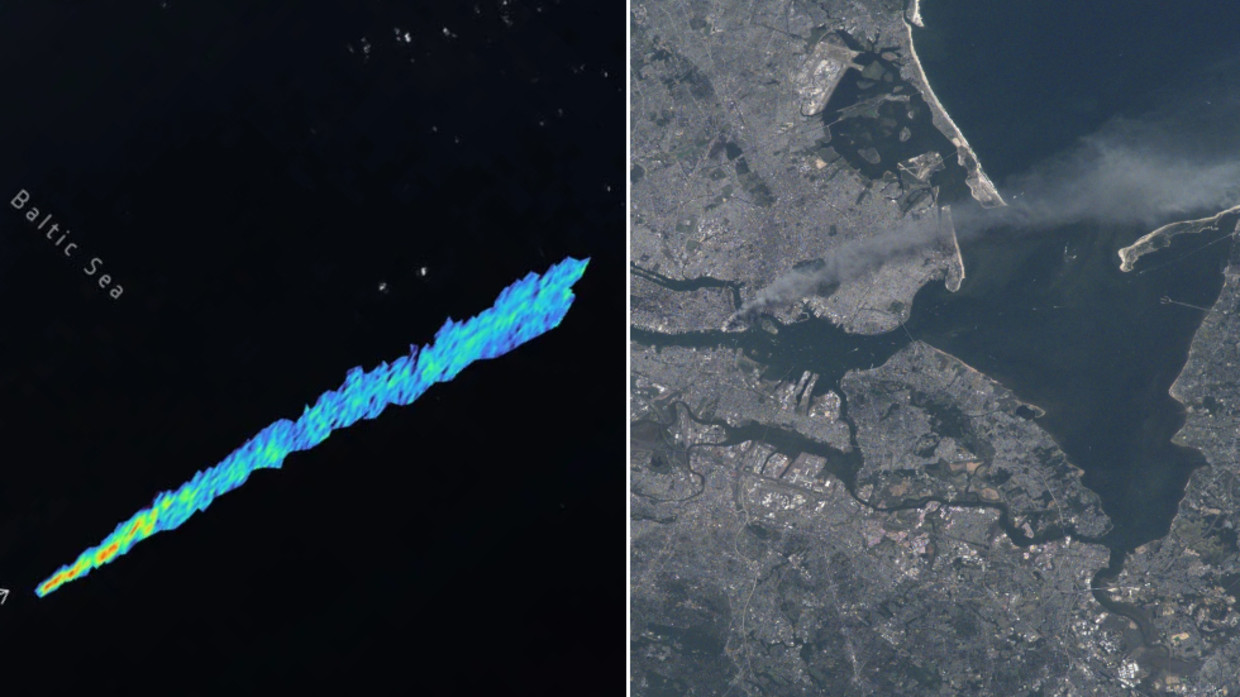

Toutes les civilisations ont dévasté l’environnement dont elles dépendaient, et se sont ainsi autodétruites. Tandis que nous écrivons ces mots, la civilisation industrielle mondialisée reproduit ce même processus en détruisant de manière systématique le monde naturel. Cela devrait être une évidence. De la (mal nommée) sixième extinction de masse des espèces (nous devrions parler d’une première destruction de masse, parler d’extinction suggère une absence de responsabilité, une sorte de fatalité naturelle) au réchauffement climatique, en passant par les nombreuses pollutions de tous les milieux (par le plastique, des métaux lourds, et d’innombrables autres formes de contamination), le constat est flagrant.

Cependant, des actes de courage, de compassion et d’altruisme abondent, même dans les endroits les plus affectés. En documentant d’une part, la résistance de ceux et celles qui sont le plus touchés par la guerre et la répression, et d’autre part, l’héroïsme de ceux et celles qui vont de l’avant pour confronter la crise la tête haute, End:Civ présente une piste pour sortir de cette folie dévorante et aller vers un avenir plus sain.

End:Civ présente des entrevues avec Paul Watson, Waziyatawin, Gord Hill, Michael Becker, Peter Gelderloos, Lierre Keith, James Howard Kunstler, Stephanie McMillan, Qwatsinas, Rod Coronado, et John Zerzan, entre autres.

Il s’agit ici de la version originale sous-titrée en français.