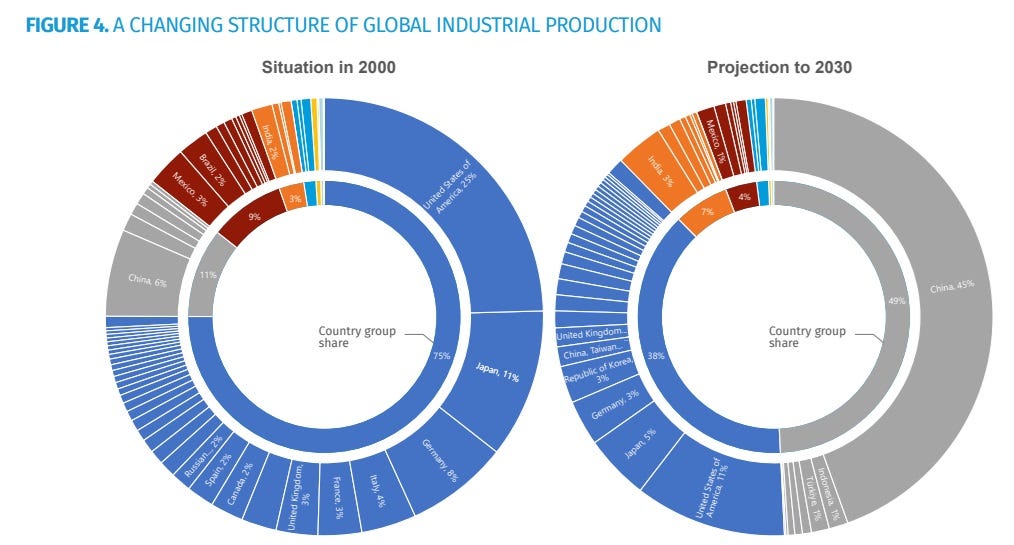

Many people think that #imperialism stopped after the U.K. became weak. Actually, the U.S. has conducted a hidden imperialism through the U.S. #dollar and has made other countries its financial colony. Today, many countries, including China, have their own sovereignty, Constitution, and government, but they are dependent on the U.S. dollar. Their products are measured in dollars and they have to hand over their material wealth to the U.S. in exchange for the U.S. dollar.

This can be seen clearly in the cycle of the U.S. dollar index over the past 40 years. Since 1971, when the U.S. started to print money freely, the U.S. dollar index has been dropping in value. For ten years, the index has kept going down, indicating that it was overprinted.

Actually, it was not necessarily a bad thing for the world when the U.S. dollar index went down. It meant an increase in the supply of dollars and a large outflow of dollars to other countries. A lot of U.S. dollars went to Latin America. This #investment created the economic boom in Latin America in the 1970s.

In 1979, after flooding the world with U.S. dollars for nearly 10 years, the Americans decided to reverse the process. The U.S. dollar index started climbing in 1979. Dollars flew back to the U.S. and other regions received fewer dollars. Latin America’s economy boomed due to an ample supply of dollar investment, but this suddenly stopped as its investments dried up.

The Latin American countries tried to save themselves.