Kyiv: full consensus for disconnecting Russia from SWIFT has been achieved, the process has begun

Kyiv: full consensus for disconnecting Russia from SWIFT has been achieved, the process has begun

Saturday, February 26, 2022 11:05:27 AMRussia will be disconnected from the international payment system SWIFT. The official decision has not yet been formalized, but technical preparations for the adoption and implementation of this step have already begun, said Ukrainian Foreign Minister Dmytro Kuleba on his Facebook page.

"We gnawed and gnawed and gnawed at it. All Ukrainian diplomacy worked – from the President of Ukraine to the attaché in the Ukrainian embassy. Ukrainian diplomats dedicate this victory to all defenders of Ukraine," Kuleba wrote.

Sources close to negotiation process on the policy of sanctions told the Ukrainian news outlet LB.ua that after the consent of Hungary and Cyprus, only the position of Germany was preventing the disconnection of Russia from SWIFT. Such step requires the consent of all EU member states. The Radio Free Europe/Radio Liberty's editor, Rikard Jozwiak, has reported that Germany has also given its consent.

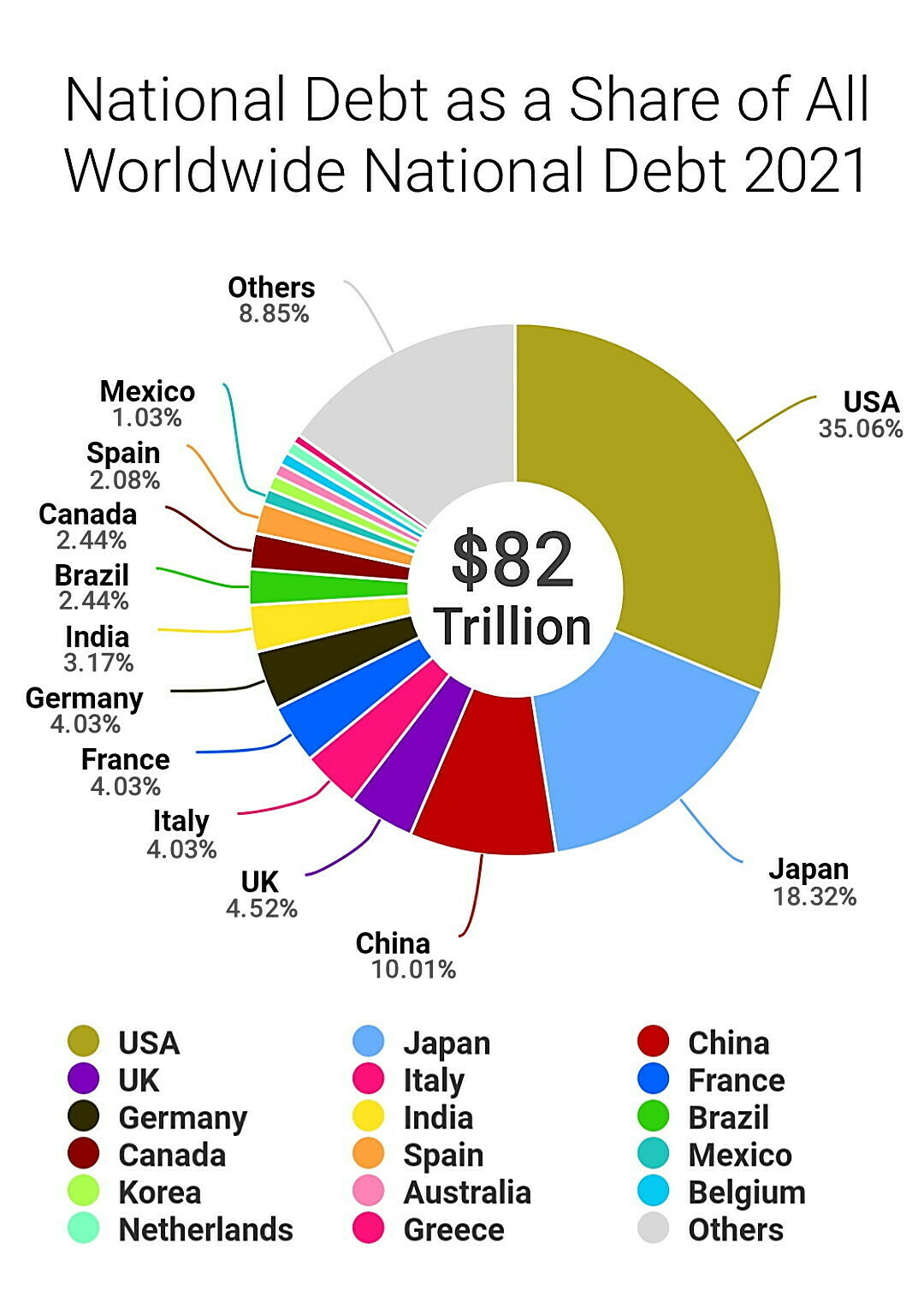

SWIFT, which stands for Society for Worldwide Interbank Financial Telecommunications, is controlled by the National Bank of Belgium and central banks from the US, UK, EU, Japan, Russia, China and others. It delivers secure messages to more than 11,000 financial institutions and companies in more than 200 countries and territories.

Only one country was removed from SWIFT in its history. in 2012, Iran was blocked from SWIFT as part of a series of measures aimed at curbing the Islamic Republic's nuclear program. ...

Germany being the last hold-out is a very poor look.

#Ukraine #SWIFT #Banking #Russia #Sanctions #Banking #InternationalPayments