#banking

https://www.youtube.com/watch?v=zXk9wWmadiQ

#TheMembers - #Offshore #Banking #Business (On Screen Lyrics)

#UK could face #banking crisis worse than 2008’ if #City fails to prepare for #FossilFuel collapse | Banking | The Guardian

#Finances #Environment #GlobalWarming #ClimateChange #FossilFuels

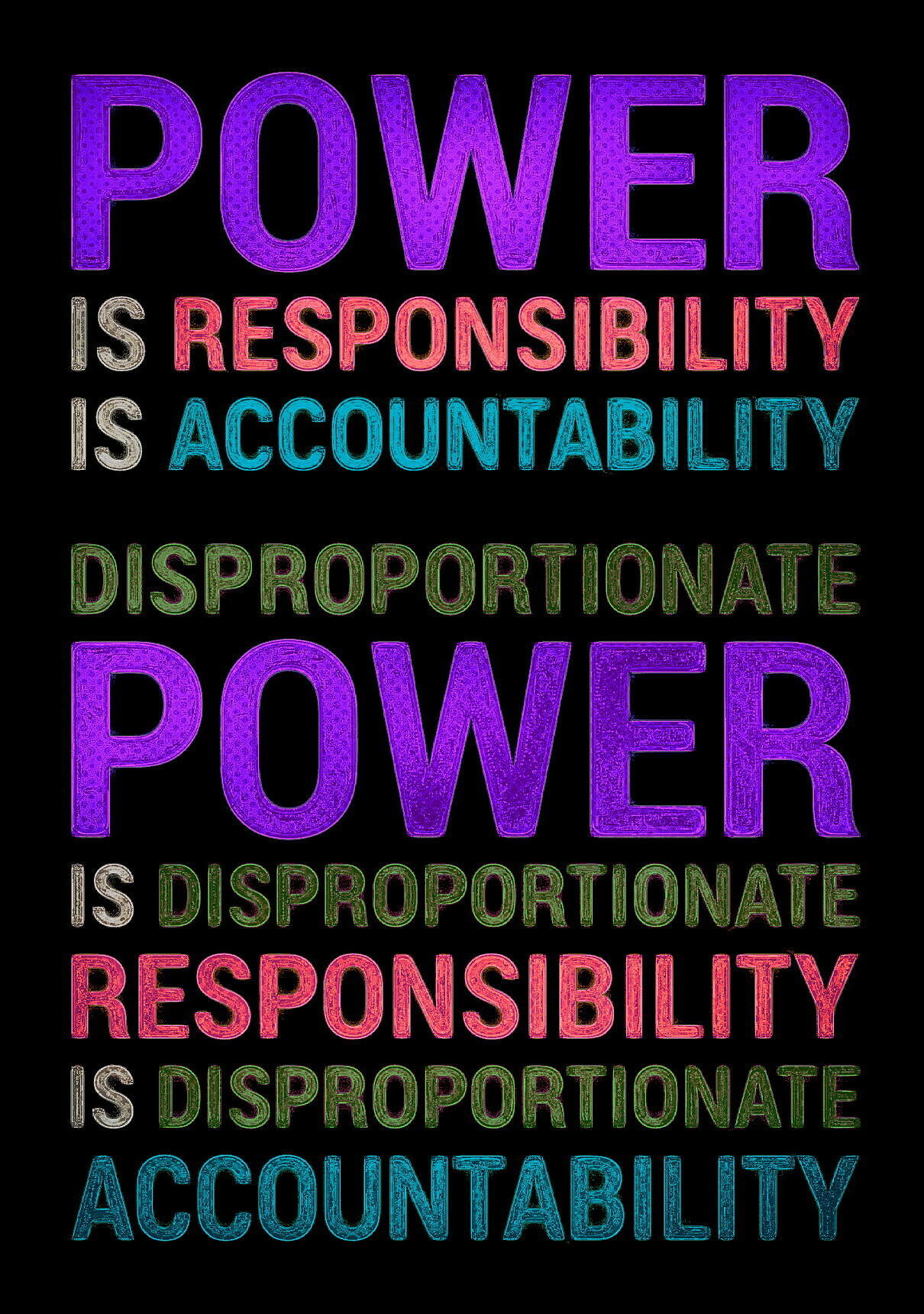

Power =

Responsibility =

Acountability.

Disproportionate Power =

Disproportionate Responsibility =

Disproportionate Accountability.

#power #responsibility #meme #usa #uk #accountability #proportionality #proportion #representation #stats #data #analysis #ethnographics #eu #ethnography #powerhierarchy #wef #powerstructure #academia #politics #economics #banking #finance #un #scions #plutocracy #corporatocracy #cronyism #cronycapitalism #jobs #nepotism #employment #migration #terrorism #multiculturalism #law #justice #westerncivilization #quote #truth #logic #philosophy #maxim

Your #debt is an asset on a bank's balance sheet. By moving your debt from one #bank to another, you are reducing the positive balance on one bank's #balance sheet & increasing it on another. If enough #people do that, a bank's share #price can be changed.

If a bank wants to try to impose a social credit system or a component of one upon you, take the asset of your debt away from them. If enough people do this, they may find a bank will change its unwanted #behaviour.

#socialcreditsystem #carboncredits #carboncreditsystem #banking #usa #debt #assets #socialengineering #banks #economiccoercion #uk #un #banksters #bankingelite #globalism #ccp #communism #technocracy #plutocracy #corporatocracy #wef #socialcredit #photosynthesis #cfr #secretsocieties #socialengineers

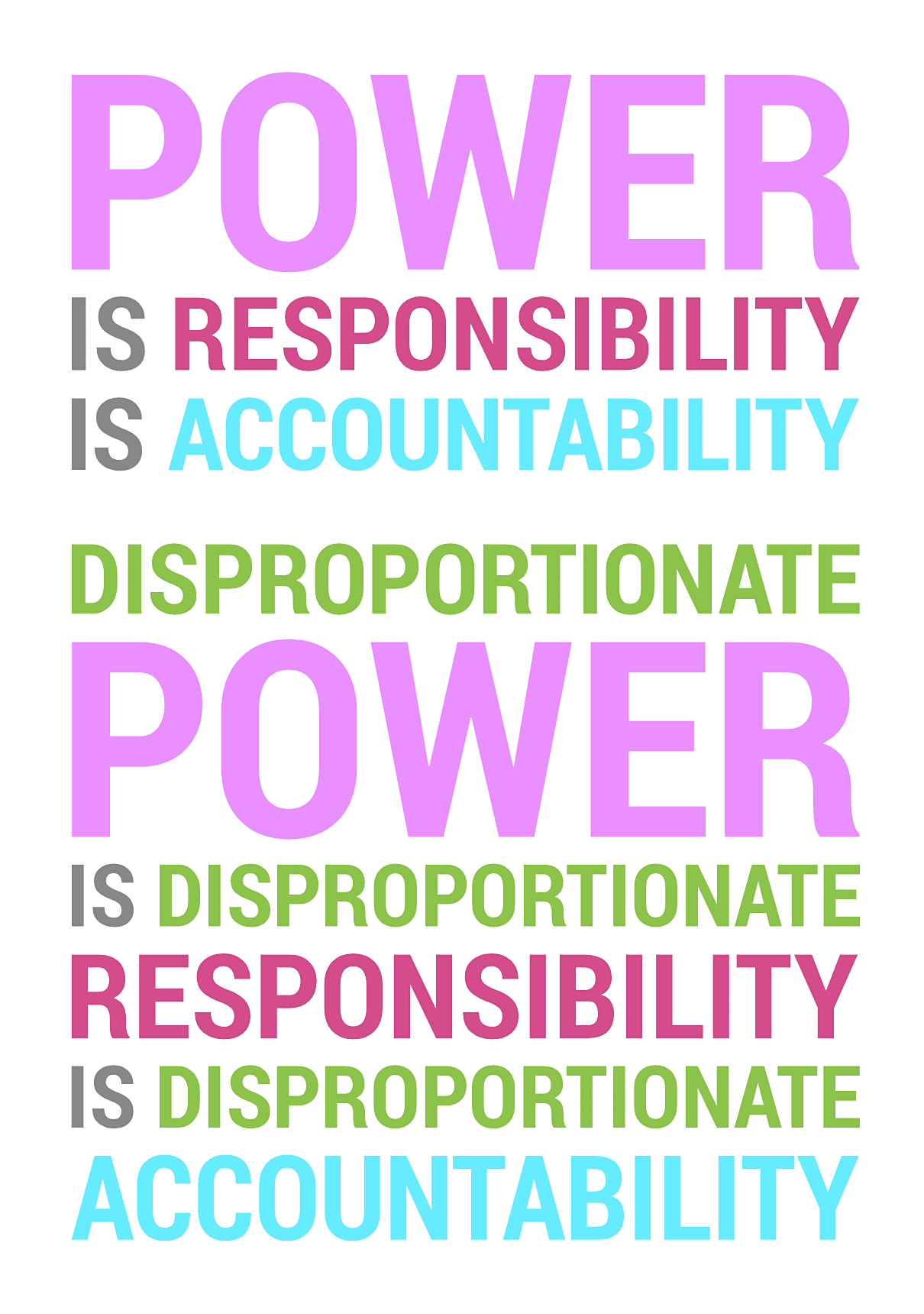

Power =

Responsibility =

Acountability.

Disproportionate Power =

Disproportionate Responsibility =

Disproportionate Accountability.

#power #responsibility #meme #usa #uk #accountability #proportionality #proportion #representation #stats #data #analysis #ethnographics #eu #ethnography #powerhierarchy #wef #powerstructure #academia #politics #economics #banking #finance #un #scions #plutocracy #corporatocracy #cronyism #cronycapitalism #jobs #nepotism #employment #migration #terrorism #multiculturalism #law #justice #westerncivilization #quote #truth #logic #philosophy #maxim

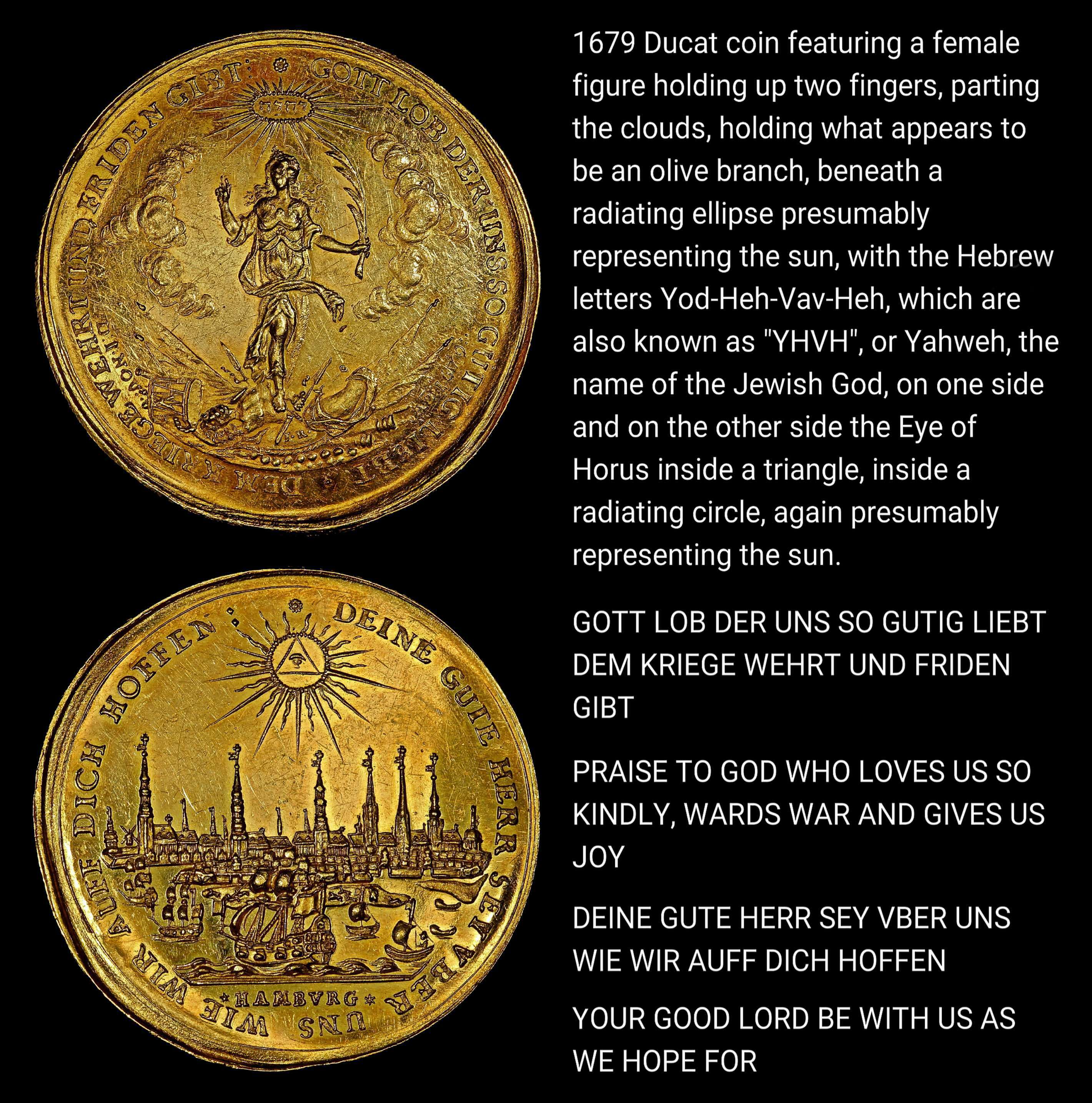

343 year old European coin from 1679 depicting Jewish symbology and text.

#jewish #jews #afroasiatic #judaic #eyeofhorus #monetarysystem #jew #religion #economics #banking #uk #interestrates #minting #theoccult #occult #occultsymbolism #egypt #atum #ra #horus #akhenaten #usa #amenhotep #aten #amenophis #un #moses #moshe #adonai #psalm104 #abrahamism #socialengineering #eu #socialengineers #societalcontrol #elites #judeoangloamericanempire #money #currency #history #power #societalpowerhierarchies #statistics #proportion #representation #theelite

Charlene Chu, famed among #China watchers for warning about a debt bubble when at Fitch Ratings, says that pain is only just beginning for credit extended to Chinese #property.

In the wake of #Beijing’s sweeping crackdown on leverage built up in #realestate, China #Evergrande Group and others have defaulted on a slew of bonds. Chu, a senior analyst at Autonomous Research, a division of Sanford C. Bernstein & Co., estimated that “we have 30 companies who’ve defaulted with total liabilities of around $1 trillion.”

While banks have the safeguard of collateral for their loans to developers, “where things could start to get a lot more ugly” is if lenders start revaluing that collateral lower, Chu said in a June 15 interview with the One Decision podcast.

“We’re just so early in this process of these defaults happening, and restructurings usually take quite a long time,” said Chu, who was known at Fitch for warning in the early 2010s over debt risks in the shadow #banking sector. “We haven’t really gotten to the point of saying, ‘OK, well, what really is going to happen with that building?’”

https://www.bloomberg.com/news/articles/2022-07-07/china-property-slide-early-in-game-after-1-trillion-defaults #finance #crisis #economy

how much is the phish? The phone-system but also the E-Mail system, are amongst the oldest, digital systems still in use today (the first E-Mail was send 1971). Unfortunately both systems - back then - were not designed with security in mind.[...]

#linux #gnu #gnulinux #opensource #administration #sysops #cyber #itsec #cybersec #itsecurity #dkb #bank #banking #phishing #phish #yandex #sdk #privacy

Originally posted at: https://dwaves.de/2022/05/10/cyber-it-security-news-dkb-phishing-fake-mails-and-sms-software-minimalism-is-data-protection-is-privacy-is-key-36-of-android-apps-build-with-yandex-sdk/

cyber it-security news - DKB phishing fake mails AND sms

how much is the phish? The phone-system but also the E-Mail system, are amongst the oldest, digital systems still in use today (the first E-Mail was send 1971). Unfortunately both systems - back then - were not designed with security in mind.[...]

#linux #gnu #gnulinux #opensource #administration #sysops #cyber #itsec #cybersec #itsecurity #dkb #bank #banking #phishing #phish

Originally posted at: https://dwaves.de/2022/05/10/cyber-it-security-news-dkb-phishing-fake-mails-and-sms/

Zapper turns smartphones into card machines – virtually all digital payments accepted without the need for point of sale hardware, customers no longer need the app either

Zapper has announced that their merchants will now be able to accept tap-on-phone payments. This includes Samsung Pay, Apple Pay, and Garmin Pay. Customers no longer have to download the Zapper app for merchants to accept payments through the Zapper platform.

“The software responsible for capturing, submitting and processing payments has been lab-tested and approved by both MasterCard and Visa,” the company said.

See https://mybroadband.co.za/news/banking/442958-zapper-turns-smartphones-into-card-machines.html

#southafrica #zapper #banking #technology

#Blog, ##banking, ##mobile, ##southafrica, ##technology, ##zapper

If you look hard enough, deep enough, you will find the root cause of all our problems is the banking system ...

via Khuram Malik

#muamalat #معاملات #labor #bank #banking #usury #capitalism #society #market #markets #technology #autarky #freedom #ربا #history #culture #society #economics #Islam #Sharia #Shariah #Shariat #Sufi #Sufism #Muslim #muamalah #riba #تَصَوّف

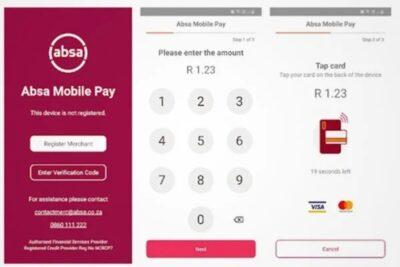

Absa launches Mobile Pay in South Africa — Turn your smartphone into a POS card machine

Absa Mobile Pay is specifically aimed at small to medium enterprises seeking a cost-effective solution with no monthly device rental or callout fees for POS terminal repairs. Absa said the solution requires only the app, which can be downloaded from the Google Play Store, with no additional hardware, plug-ins, card readers or dongles necessary. The device does need to have NFC capability.

Absa said the app has been certified by Mastercard and Visa with regard to functional, security and branding requirements.

#technology #ABSA #southafrica #banking #POS

#Blog, ##absa, ##banking, ##pos, ##southafrica, ##technology

Study, study, #study. The deception, mendacity & falsehoods go back to the mid 19th century.

#WW1, #WW2, #Communism, the #USA, the #French #Revolution, the #British #Empire, the #NAZIs, the #Bolsheviks, the #Cold #War, the #EU, #multiculturalism, #globalism, the #NSA, the #CIA, #GCHQ, #MI6, the five eyes, Central #Banking, global #plutocracy, #surveillance #capitalism, smart devices, #endocrine #manipulation, applied #psychology, social #engineering, #education systems, historical #narratives, #information control, faux #Hegelian dialectics, #propaganda, manufacturing #consent, #eugenics, #perception management, #secret societies, #blackmail honeypots, puppet #politicians, societal #control mechanisms, #psychosocial reality formation.

Kyiv: full consensus for disconnecting Russia from SWIFT has been achieved, the process has begun

Kyiv: full consensus for disconnecting Russia from SWIFT has been achieved, the process has begun

Saturday, February 26, 2022 11:05:27 AMRussia will be disconnected from the international payment system SWIFT. The official decision has not yet been formalized, but technical preparations for the adoption and implementation of this step have already begun, said Ukrainian Foreign Minister Dmytro Kuleba on his Facebook page.

"We gnawed and gnawed and gnawed at it. All Ukrainian diplomacy worked – from the President of Ukraine to the attaché in the Ukrainian embassy. Ukrainian diplomats dedicate this victory to all defenders of Ukraine," Kuleba wrote.

Sources close to negotiation process on the policy of sanctions told the Ukrainian news outlet LB.ua that after the consent of Hungary and Cyprus, only the position of Germany was preventing the disconnection of Russia from SWIFT. Such step requires the consent of all EU member states. The Radio Free Europe/Radio Liberty's editor, Rikard Jozwiak, has reported that Germany has also given its consent.

SWIFT, which stands for Society for Worldwide Interbank Financial Telecommunications, is controlled by the National Bank of Belgium and central banks from the US, UK, EU, Japan, Russia, China and others. It delivers secure messages to more than 11,000 financial institutions and companies in more than 200 countries and territories.

Only one country was removed from SWIFT in its history. in 2012, Iran was blocked from SWIFT as part of a series of measures aimed at curbing the Islamic Republic's nuclear program. ...

Germany being the last hold-out is a very poor look.

#Ukraine #SWIFT #Banking #Russia #Sanctions #Banking #InternationalPayments