#BernardArnault #Richesse #multimilliardaire #Capitalisme, #Inégalités #Économie

💰 Avec Bernard Arnault, quelques rappels d’économie

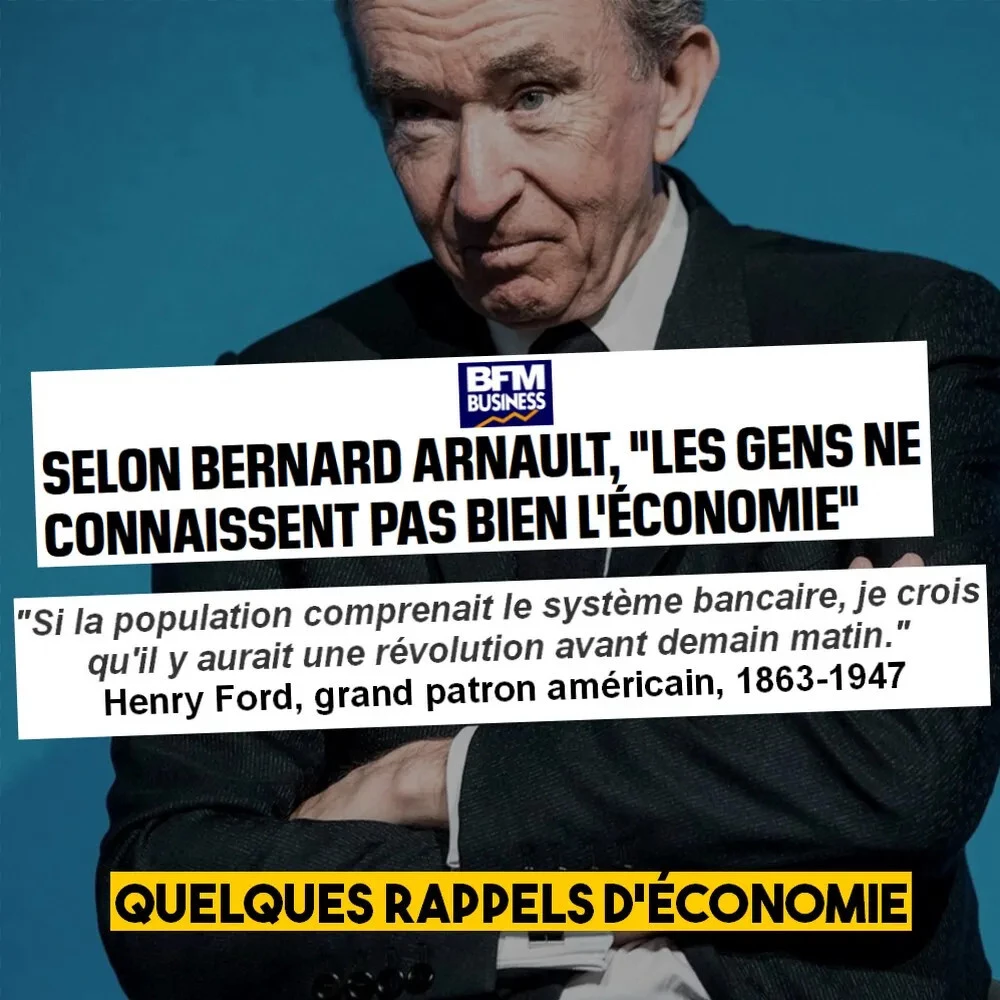

«Je constate avec un peu de surprise – encore qu’en France, il ne faut jamais être surpris – que les gens ne connaissent pas bien l’économie, donc on se fait critiquer par des gens qui ne connaissent pas bien le sujet dont ils parlent».

C’est la déclaration condescendante de l’homme le plus riche du monde, le multimilliardaire français Bernard Arnault. En réalité, il devrait se réjouir que la majorité de la population ne connaisse pas les rouages de l’économie.

Un autre grand capitaliste déclarait au siècle dernier :

**«si la population comprenait le système bancaire, je crois qu’il y aurait une révolution avant demain matin.»

L’auteur de cette phrase n’était pas un #révolutionnaire mais le patron américain #Henry-Ford, celui qui a crée un empire automobile, organisé le travail en tâches séparées et cadencées dans les usines pour augmenter la productivité. Accessoirement, #Ford a aussi soutenu et financé le régime #nazi. Sa citation est pourtant toujours aussi vraie.

Alors avec Bernard Arnault, quelques rappels utiles :

➡️ Pendant le #Covid, les grandes entreprises ont pu emprunter aux #Banques-Centrales de l’argent à taux négatif. Cela veut dire que l’emprunteur rembourse moins que ce qu’il a emprunté ! Bernard Arnault lui même s’étonnait lors d’une conférence à l’école polytechnique sur cet «argent qui se déverse de manière incroyable, donné par les #banques centrales. Nous, le groupe #LVMH, on emprunte à des #taux-négatifs. C’est la première fois dans les affaires qu’on nous dit ”monsieur on va vous prêter de l’argent et en plus on va vous payer.” C’est formidable.»

➡️ La rémunération réelle des #PDG a augmenté de 1460% de 1978 à 2021. Pendant ce temps, le revenu du #travailleur type n’a augmenté que de 18,1%.

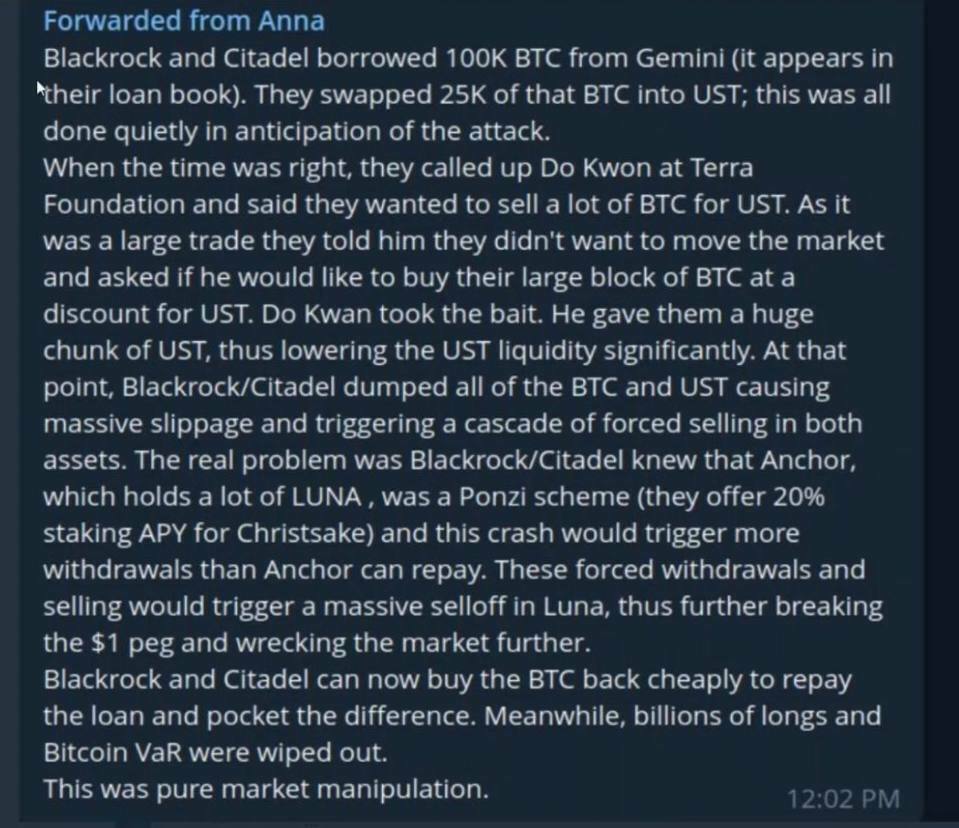

➡️ La #multinationale financière #Blackrock, qui spécule notamment sur les retraites privées, gère une somme de 6300 milliards d’euros. L’équivalent à deux fois le PIB de la France.

➡️ #Total a versé 13 milliards de dividendes cette année en France. Le déficit maximal du système de retraite selon le gouvernement serait de 12 milliards.

➡️ L’ #État français #emprunte ces derniers mois à des taux «indexés sur l’inflation». Plus les prix augmentent, plus la charge de la dette publique augmente. Les dirigeants français organisent la #banqueroute de l’État. Les centaines de millions empruntés peuvent être remboursés jusqu’à 143% de leur valeur en fonction de l’ #inflation. À votre avis, qui va payer la différence durant les 10 prochaines années ? Pas Macron avec son argent personnel.

➡️ En 25 ans, le prix de l #’immobilier, en France, a triplé, passant, de 1056€ le m2 en moyenne à 2807€ en 2021. Rien qu’à Paris, en 25 ans, le prix de l’immobilier a été multiplié par 5. Une #crise du #logement organisée par et pour les #spéculateurs et les #rentiers qui s’engraissent comme jamais sur les loyers.

➡️ Rien qu’en 2020, en pleine #pandémie, les 500 plus grandes fortunes françaises ont augmenté leur patrimoine de 300 milliards d’euros, alors même que la #misère s’abattait pour des millions de #précaires. Cette infime minorité de fortunés possédait 6% du PIB français il y a 25 ans. Elle en détient 47% aujourd’hui.

➡️ Si l’on prélevait un faible pourcentage de la fortune d’un seul homme, Bernard Arnault, on pourrait financer la retraite de 70 millions de personnes. Et le pire c’est que rien ne changerait à son mode de vie.

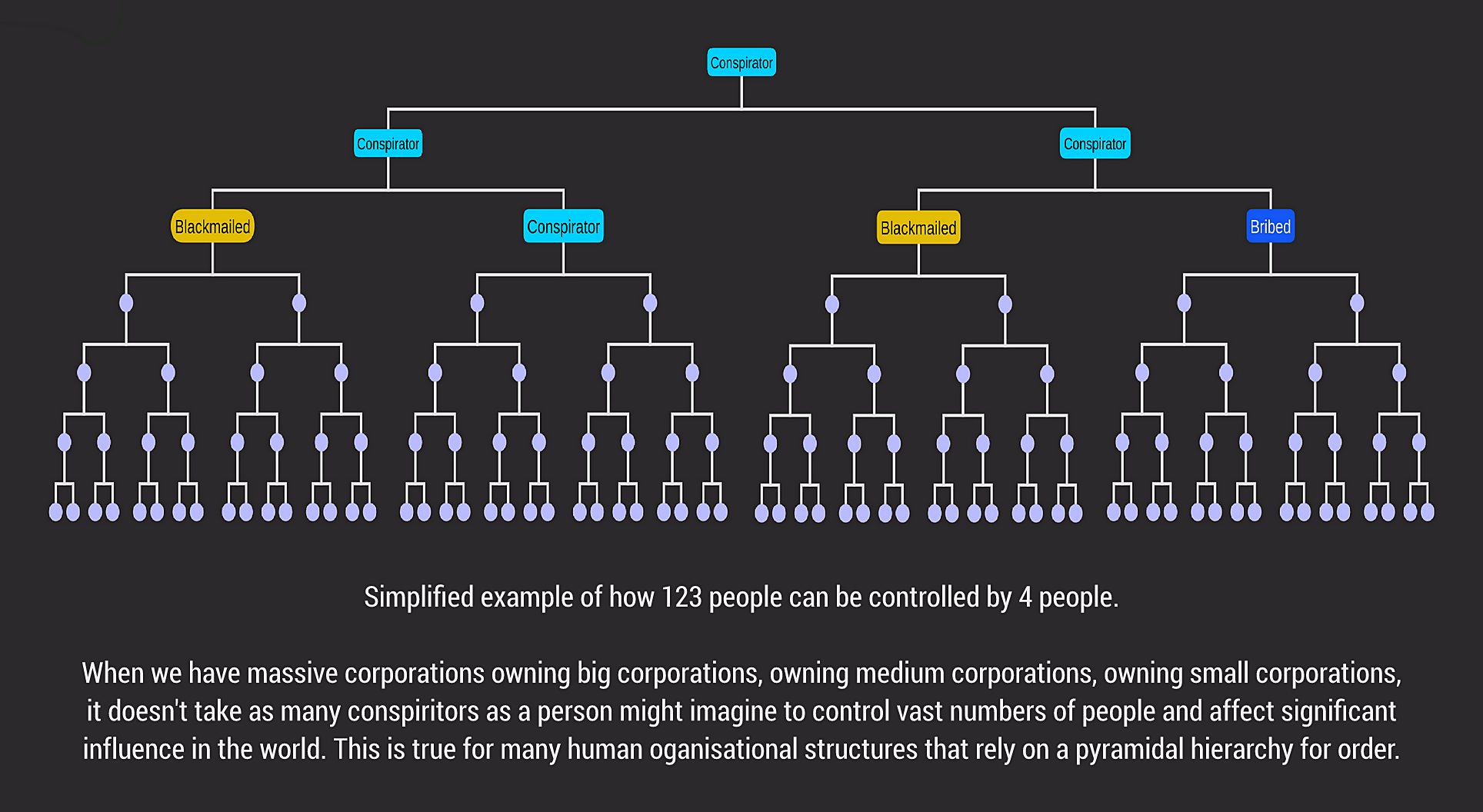

L’homme le plus riche du monde a raison. L’économie est un univers obscur pour beaucoup de gens. Et heureusement pour les #ultra-riches, car leur #pillage organisé reste trop mal connu.